Featured

Citi Elevate Checking

But the rates offered arent very competitive and although its an online account its not available in all areas. Account Package must contain an Interest Checking account.

Citibank High Yield Checking Review 0 60 Apy Up To 25k Many States

Citibank High Yield Checking Review 0 60 Apy Up To 25k Many States

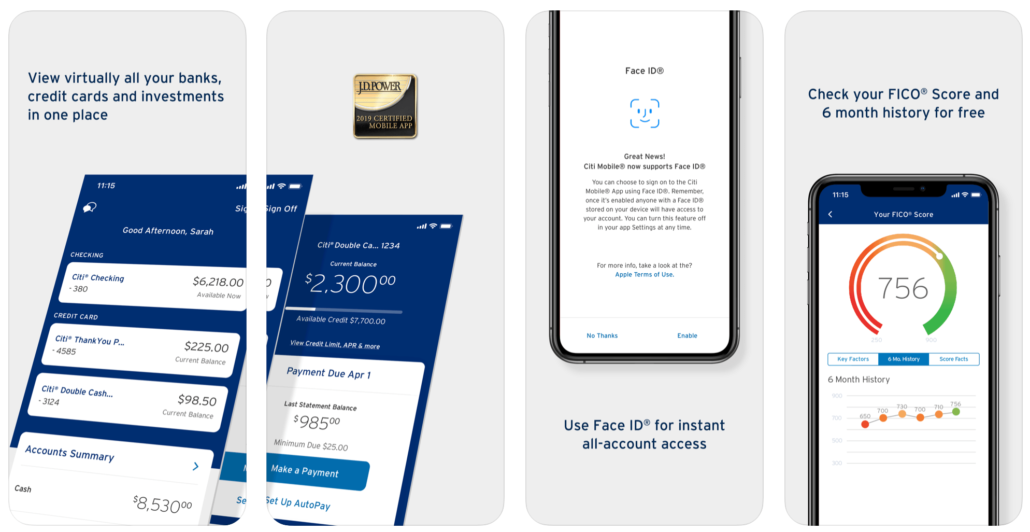

New York Citibank announced today that it is introducing Citi Elevate Checking a digital high-yield checking account that offers unlimited ATM reimbursements nationwide while.

Citi elevate checking. If you overdraw your checking account you will have automatically requested a loan from your Account. It must be opened alongside a Citi checking account. Citizen or resident and have an address in one of the locations mentioned above.

You can open Citi Elevate through the Citi Accelerate Savings account or Interest Checking account. The Citi Accelerate high-yield savings account must also be opened with a Citibank checking account package. A valid ID is required in addition to employment and.

The new Citi account on the other hand will pay the 1 interest only on accounts with balances of 25000 or more and the monthly 15 account fee will be waived only for balances above 5000. Keep in mind that if you earn the interest in you pay tax on it. Citis Elevate Checking package is a digital account that comes with reimbursed ATM fees and overdraft protections.

Only one Interest Checking account can be included in any Citi Elevate. Deposits less than that. However more than one Citi Accelerate Savings account or Certificate of Deposit account may be included in any Citi Elevate.

Requesting a transfer from your Account to your deposit account. If you earn it in the form of TY points you dont. Consumer Banks strategy to deliver a truly client-centric relationship and.

You can only apply for the Citibank Citi Elevate Checking Account Package online. Response 1 of 4. Citigroup is launching a new digital checking account featuring unlimited free ATM withdrawals and fee reimbursements and interest rates of Citi Elevate checking account has zero ATM fees and up to 1 interest TodayHeadline.

But this isnt your typical interest-earning checking account. Open a bank account from Citi checking and savings accounts and CDs to banking IRAs. A standout feature of the Citi Elevate checking account is the opportunity to earn interest.

Citibank announced today that it is introducing Citi Elevate Checking a digital high-yield checking account that offers unlimited ATM reimbursements nationwide while paying interest up. The launch of Citi Elevate Checking is the natural next step in the US. To apply you must be an 18 US.

You cannot open this savings account without opening a checking. Apply for a personal loan or learn how to invest in your financial future. We will make the loan to you by transferring from your Account to your checking account the amount needed to cover your overdraft and any applicable fees rounded up to the next 100 increment.

Youll be asked to provide your full name date of birth Social Security Number address email and phone number. The 1 interest rate for the new Citi Elevate accounts only apply to customers with more than 25000 in deposits. The most appropriate option is the Citi Elevate account which is designed to be available for the same markets as the Citi Accelerate Savings.

Citi Elevate Banking Package that includes an Interest Checking account Monthly Service Fee 15 This fee is waived when you maintain 5000 or more in average monthly balances in your Interest Checking account.

New Citi Elevate Checking Account Launched Up To 1 Interest Unlimited Atm Reimbursements Danny The Deal Guru

New Citi Elevate Checking Account Launched Up To 1 Interest Unlimited Atm Reimbursements Danny The Deal Guru

Citi Accelerate High Yield Savings Still 0 50 Apy

Citi Accelerate High Yield Savings Still 0 50 Apy

Https Online Citi Com Jrs Popups Ao Citi Elevate Plain Talk Pdf

![]() Citi Elevate Checking Account Review Mybanktracker

Citi Elevate Checking Account Review Mybanktracker

Citi S New Checking Account Pays Interest And Reimburses Atm Fees But There S A Catch Cnn

Citi S New Checking Account Pays Interest And Reimburses Atm Fees But There S A Catch Cnn

Citibank Account Package Review 2021 1 Update 300 Offer Us Credit Card Guide

Citibank Account Package Review 2021 1 Update 300 Offer Us Credit Card Guide

Citi Elevate Checking Review Up To 70 Apy Finder Com

Citi Elevate Checking Review Up To 70 Apy Finder Com

Citibank 200 400 700 Checking Account Bonus 2020 My Money Blog

Citibank 200 400 700 Checking Account Bonus 2020 My Money Blog

Citibank Launches Digital Checking Account With 1 Apy Unlimited Reimbursed Atm Fees Citi Elevate Review Doctor Of Credit

Citibank Launches Digital Checking Account With 1 Apy Unlimited Reimbursed Atm Fees Citi Elevate Review Doctor Of Credit

Citi Debuts Its Online High Yield Checking Account Business Insider

Citibank Promotions 75 150 300 400 500 700 750 1500 2000 3000 Offers For Checking Savings

Citibank Promotions 75 150 300 400 500 700 750 1500 2000 3000 Offers For Checking Savings

Citi Elevate Checking Account Has Zero Atm Fees And Up To 1 Interest

Comments

Post a Comment