Featured

Banks Likely To Go Public

JP Morgan blue. The letter sent out on 12 October has asked for voluntary responses by 12 November ahead of the Banks final Monetary Policy Committee MPC meeting for this year on 17 December.

Crypto Exchange Coinbase Is Seeking An Early 2021 Ipo

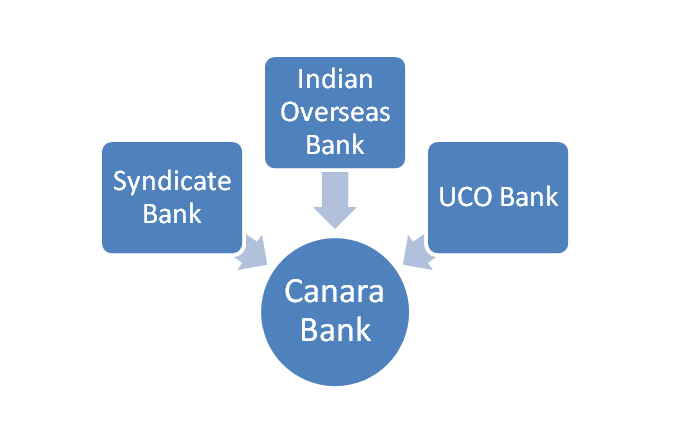

Syndicate Bank into Canara Bank.

Banks likely to go public. The central bank very clearly prefers XRP over. State Bank of Bikaner and Jaipur SBBJ State Bank of Hyderabad SBH State Bank of Mysore SBM State Bank of Patiala SBP and State Bank. Tata Capital Bajaj Finance CSB Bank likely to bid for the public sector bank.

This report from CPA Australia claims that the Banque de France has reportedly discussed using the Ripple platform for the launch of its central bank digital currency. Even as the central government is going for disinvestment in PSUs. Two years ago it even circled an exact deadline by which it hoped to go public 18th November 2020 and then reportedly began talks with banks to start the process last December.

Big banks - One of the most common places to get a mortgage is through large lenders in the banking space. Following the consolidation there are now seven large public sector banks and five smaller ones. Depositor-owned banks in Mass.

Build their own projects with all the overhead that implies or work with well-placed existing. Rivka Abramson January 18 2021. Still its CEO told Sifted in February that this is still a goal rather than a definitive plan meaning that a public listing soon is likely but still speculative.

So most are really being snatched up as soon as they are available. As several fintech trends take hold this may be the year for fintech IPOs. Continuing strong credit growth of private banks at 220 y-o-y in the third quarter of 2018-19 will push them to offer competitive rates says Ind-Ra.

Investment bankers will tell you that 60 to 80 of these banks get acquired within three to five years of going public. Banks Likely to Adopt Stablecoins Cautiously Despite Guidance Banks face a stablecoin conundrum. Bank guarantees are here to stay.

Angling to go public Virtually all banks with more than 4 billion in assets depend on income from selling stock to fuel their growth. BankMobile likely to be first of many to go public this year. Bank stocks go down Key.

Bank of France the countrys central bank is likely to prefer Ripple over Bitcoin and Ethereum and has openly discussed the XRP Ledger as a possible platform for the CBDC. In late 2016 CEO Zander Lurie told TechCrunch that his company is more than likely to go public after 2017 explaining that they want to do it on their own terms. The majority of the Banks that went public were eventually bought by a bigger bank.

As a general rule when a politician says that a policy is temporary it will become permanent. A lot of bank deals between public banks. These are well-known brands and typically available nationwide -.

The Bank of England has sent letters to the CEOs of several financial firms to ask how their company would cope if the Bank were to reduce the base rate to 0 or to introduce a negative rate. This information comes around a time when several banks across the country called for a nationwide strike on March 15-16 against the privatisation of Public Sector Banks. Although that number is in line with 2017s pace.

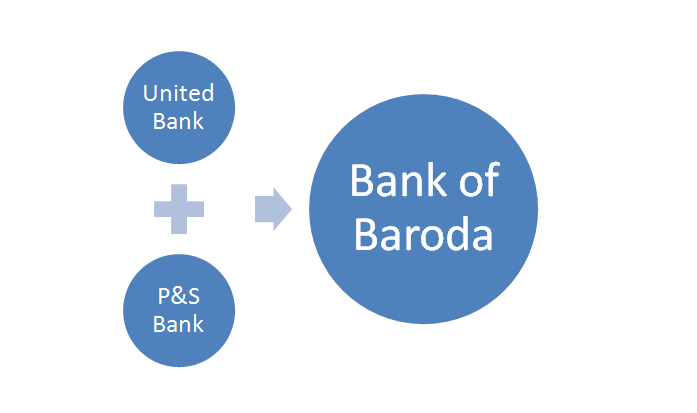

As per the consolidation plan Oriental Bank of Commerce and United Bank of India were merged into Punjab National Bank. Middlesex Savings Bank is. And Allahabad Bank into Indian Bank.

Citigroup light blue. Several studies analyzing the performance of stocks of Mutual Savings Banks that went public through the Demutualization process show that the investors that purchased those stocks at the Initial Public Offering the depositors before the bank went publc made well above-average returns within the first one three and five years of going public. Thats what some officials have begun to realize.

Bank of America violet. BankMobile recently went public through its merger agreement with Megalith Financial Acquisition Corp a special purpose acquisition company. Andhra Bank and Corporation Bank into Union Bank of India.

As Eastern Bank noted in its prospectus going public would allow the bank to purchase other banks using its stock cash or both. There were as many as 27 PSBs in. However investors should not chase only high rates of fixed deposits as they often come with longer tenures and hidden terms and conditions.

Wells Fargo purple.

Mufg Whets Appetite For Thai Banks After Majority Stake Bid South China Morning Post

Mufg Whets Appetite For Thai Banks After Majority Stake Bid South China Morning Post

When Community Banks Should Go Public Banking Exchange

When Community Banks Should Go Public Banking Exchange

Budget 2021 Highlights Two Psu Banks One Insurance Firm To Be Privatised Lic Ipo This Year

Budget 2021 Highlights Two Psu Banks One Insurance Firm To Be Privatised Lic Ipo This Year

Four Small Banks That Are Acquisition Candidates The Motley Fool

Four Small Banks That Are Acquisition Candidates The Motley Fool

Vietnamese Banks Likely To Miss Government S Listing Target Again Analysts Say S P Global Market Intelligence

Vietnamese Banks Likely To Miss Government S Listing Target Again Analysts Say S P Global Market Intelligence

Sbi Pnb Bob May Go For Share Sale This Fiscal

Sbi Pnb Bob May Go For Share Sale This Fiscal

Why Are So Many Community Banks Going Public

Why Are So Many Community Banks Going Public

Number Of Public Sector Banks Likely To Go Down From 21 To 12 As Government Mulls Consolidation India Com

Number Of Public Sector Banks Likely To Go Down From 21 To 12 As Government Mulls Consolidation India Com

Algeria Plans Bank Privatizations As Oil Money Dries Up Arab News

Algeria Plans Bank Privatizations As Oil Money Dries Up Arab News

After Sbi More Public Sector Banks Merger On Cards

After Sbi More Public Sector Banks Merger On Cards

Banking More Fund Infusion Likely In Public Sector Banks The Economic Times

Banking More Fund Infusion Likely In Public Sector Banks The Economic Times

Govt Identifies 3 4 Regional Rural Banks For Ipos Public Issue Likely This Year

Govt Identifies 3 4 Regional Rural Banks For Ipos Public Issue Likely This Year

Comments

Post a Comment