Featured

Vtsax Vs Sp500

You can buy VOO with any brokerage TD Ameritrade Fidelity Charles Schwab Etrade etc you are not restricted to Vanguard whereas with the VFINX and VFIAX you need to. And VTSAX contains every publicly traded company in the US but these two indices have nearly identical annual returns.

S P 500 Vs Nasdaq 100 Which Index Is Better Four Pillar Freedom

S P 500 Vs Nasdaq 100 Which Index Is Better Four Pillar Freedom

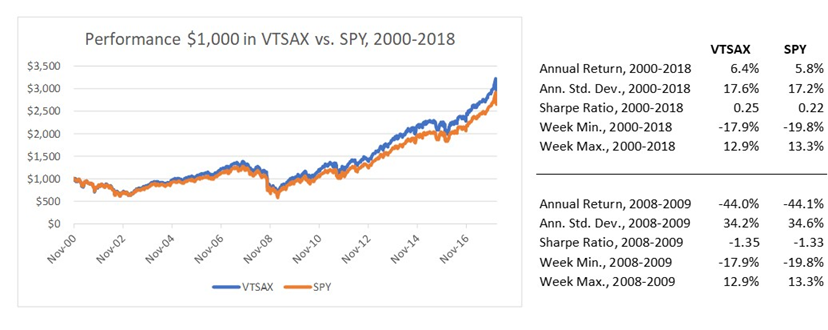

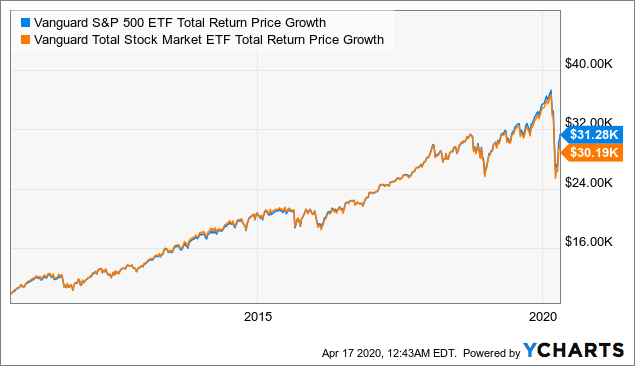

If you have an SP 500 index fund vs a total stock market fund the total stock market fund would win due to having more companies that are within the fund.

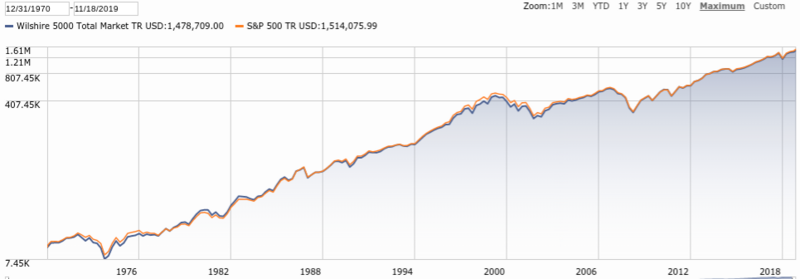

Vtsax vs sp500. Stock market index benchmark. The Vanguard Total Market Index fund VTSMX was introduced on April 27 1992 and earned an average return of 810 percent annually through January 15 2010. The VTSAX may have a few advantages over the most popular SP 500 ETFs including very low management fees and diversification across thousands of.

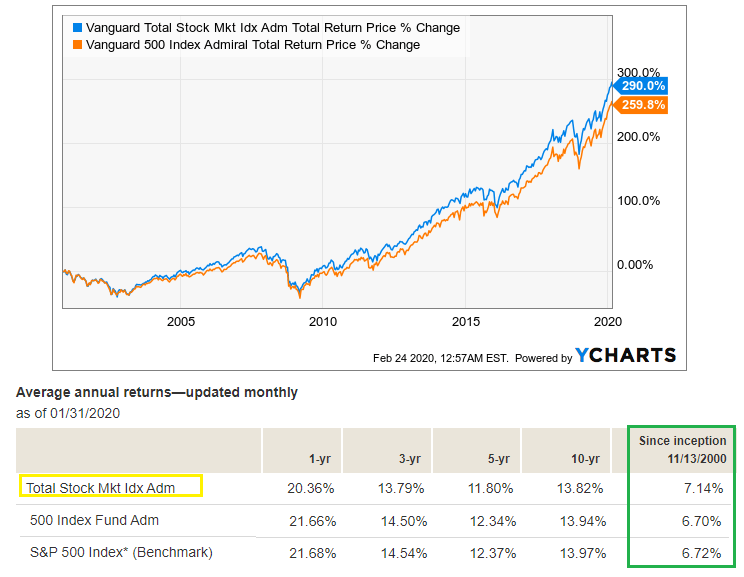

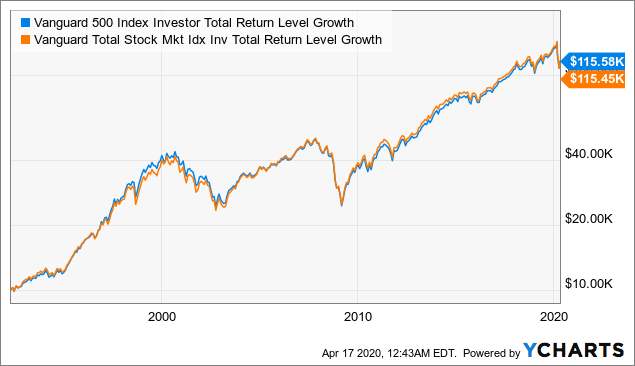

Compare the funds long-term total return from inception to the present against a general benchmark the SP 500 Index the most commonly utilized US. VTSAX and VFIAX have the same expense ratio 004. VTSAX charges an extremely low expense ratio of 004 and requires a minimum investment of 3000.

Both the Vanguard Total Stock Market Index and. 0043 ①信託報酬の比較0313 ②投資対象の比較0550 ③純資産総額の比較0730 ④FOYランキングで比較0900 楽天VTIからSlim米国株式に乗り換えるべきか. VTSAX would also be a solid general comparison fund Compare the funds long-term total return to a benchmark index for its same category.

Many investors have no desire to tilt our portfolios towards small-cap stocks. In the past 15 years the total stock market has had slightly higher long-term returns because of its mid-cap and small-cap components. Its important to note that since VTSAX is market-cap weighted the 3128 smaller stocks actually only comprise a small portion of the total fund.

VTSAX has a higher 5-year return than VFIAX 1837 vs 1777. VTSAX tracks the total stock market index. In fact about 75 of VTSAX is composed of stocks in the SP 500.

Total Stock Market Index vs. The Fund attempts to replicate the target index by investing all of its assets in the stocks that make up the Index with the same approximate weightings as. Enroll in our NEW Stock Market Investing Course for Financial Independence and Retiring Early.

In addition most people dont realize just how large the largest stocks in the SP 500 are relative to the other stocks in the index. The VFIAX will do a little better if large caps are doing well and the VTSAX will do a little better if small and mid caps are doing better than large caps. VTSAX has a 047 higher average annual return and 043 higher CAGR compound annual growth rate which may seem small but compounded out over the long term makes a huge difference.

The portfolio of Vanguard 500 Index VFINX which follows the SP 500 has an average market cap of 546 billion. The Fund employs an indexing investment approach. Click a fund name to view the fund profile for additional detail.

This effectively has an impact on the diversification of your portfolio. Both the Vanguard Total Stock Market Index and. The VOO is a closed-end mutual fund that does pretty much exactly the same thing track the SP500.

The Fund seeks to track the performance of its benchmark index the SP 500. I realize that the SP 500 only contains the largest 500 publicly traded companies in the US. A 10000 investment ten years ago in both funds would have grown to 19845 in the total market fund and 19543 in the SP 500 index fund.

While AGTHX is a large-cap fund its specifically a large-cap. Total market funds typically track an. Vanguard Index Fund Ticker 1-Yr.

VTSAX and VFIAX have the same expense ratio 004. Total Stock Market Index VTSAX-113. SP 500 Index VFIAX 082.

By contrast the Vanguard Total Stock Market VTSMX. In practice VTSAX is mostly SP 500 anyway because its market weighted and that is where most of the capital is. Vanguard 500 Index Fund Admiral Shares VFIAX Takeaways from the table.

Below is the comparison between VTSAX and VFIAX.

Vtsax Vs Sp500 Vanguard Vs Charles Schwab Which Is Best For Index Fund Investors

Vtsax Vs Sp500 Vanguard Vs Charles Schwab Which Is Best For Index Fund Investors

Vtsax A Benchmark For Broad Market Passive Equity Exposure Vtsax Seeking Alpha

Vtsax A Benchmark For Broad Market Passive Equity Exposure Vtsax Seeking Alpha

Opinion Shocker The S P 500 Is Underperforming The Stock Market Marketwatch

Opinion Shocker The S P 500 Is Underperforming The Stock Market Marketwatch

3 Reasons Why The Vanguard Total Stock Market Fund Beats The S P 500 Index Keep Investing Imple Tupid

3 Reasons Why The Vanguard Total Stock Market Fund Beats The S P 500 Index Keep Investing Imple Tupid

S P 500 Vs Nasdaq 100 Which Index Is Better Four Pillar Freedom

S P 500 Vs Nasdaq 100 Which Index Is Better Four Pillar Freedom

Vanguard S Vtsax A Better Alternative To S P 500 Funds Vtsax Seeking Alpha

Vanguard S Vtsax A Better Alternative To S P 500 Funds Vtsax Seeking Alpha

Vtsax Vs Vfiax Which Index Fund Is Better Four Pillar Freedom

Vtsax Vs Vfiax Which Index Fund Is Better Four Pillar Freedom

How The S P 500 Became So Overrated Seeking Alpha

How The S P 500 Became So Overrated Seeking Alpha

S P 500 Index Vs Total Stock Market Index Bogleheads Org

S P 500 Index Vs Total Stock Market Index Bogleheads Org

How The S P 500 Became So Overrated Seeking Alpha

How The S P 500 Became So Overrated Seeking Alpha

![]() Vtsax Vs Voo Which Is Best Inspire To Fire

Vtsax Vs Voo Which Is Best Inspire To Fire

A Fund That Trounces The S P 500 Wsj

A Fund That Trounces The S P 500 Wsj

Here S Why A Total Market Approach Is Better Vs The S P 500 Etfguide

Here S Why A Total Market Approach Is Better Vs The S P 500 Etfguide

Vtsax Vs Sp500 Vanguard Vs Charles Schwab Which Is Best For Index Fund Investors

Vtsax Vs Sp500 Vanguard Vs Charles Schwab Which Is Best For Index Fund Investors

Comments

Post a Comment