Featured

Small Cap Blend Stocks

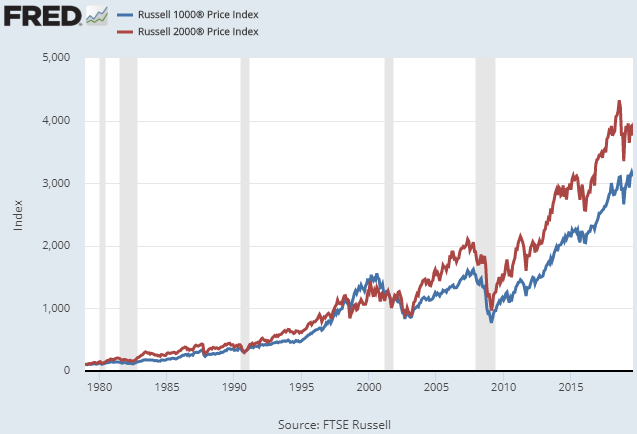

A smaller percentage of small cap stocks provide positive long-term returns compared to the percentage of large cap stocks that provide positive long-term returns. If playback doesnt begin shortly try restarting your device.

Small Cap Blend Style 2q18 Best And Worst New Constructs

Small Cap Blend Style 2q18 Best And Worst New Constructs

The Best for Active Traders.

Small cap blend stocks. IShares Core S. The Best International Fund. The ETFs may also own various asset classes such as bonds currencies and more.

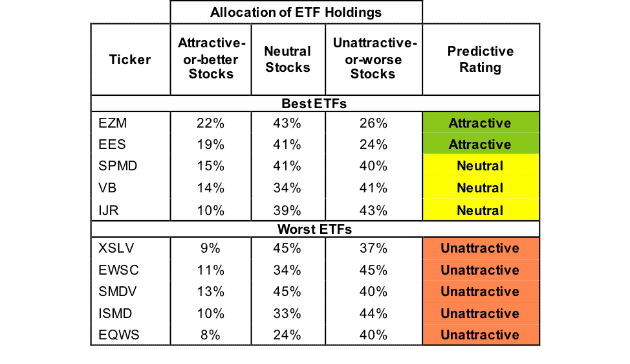

IShares Russell 2000 ETF IWM is the worst rated Small Cap Blend ETF and Small Cap ProFund SLPSX is the worst rated Small Cap Blend mutual fund. SPDR SP 600 Small Cap Growth ETF. Mega cap 100 billion micro cap 250 million and nano cap usually.

These funds offer investors diversification among these popular investment styles. IWM earns an Unattractive rating and SLPSX earns. 27 Zeilen This is a list of all US-traded ETFs that are currently included in the Small Cap.

Small Cap Blend ETFs Stocks Most of these ETFs tend to invest across the spectrum of US. When compared to small-cap and mid cap funds blend funds provide significant exposure to both growth and value stocks. A blend fund or blended fund is a type of equity mutual fund that includes a mix of both value and growth stocks.

Stocks in the bottom 10 of. Vanguard FTSE All-World ex-US. In contrast Morningstar utilizes.

Small Cap ETF. Since the share prices of these companies can be very volatile some companies in the. Small-cap stocks are public companies that have market capitalizations ranging from 300 million to 2 billion.

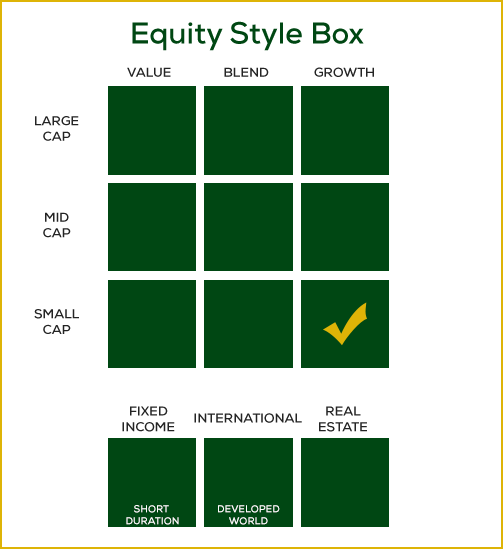

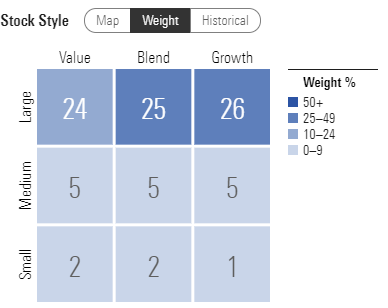

S mall-cap blend funds are a type of equity mutual fund which holds in its portfolio a mix of value and growth stocks where the market capitalization of. The Problem With Small Cap Stocks - YouTube. Vanguard Small-Cap Value Fund As you can see even a 100 small-cap value portfolio isnt 100 small-cap value but it does have 12X as much in small-cap value stocks as the overall market along with 4X as much in mid-cap value stocks 9 times as much in small blend stocks and 37X as much in mid-cap blend stocks.

There are a few other types of market caps you may see but not as often. The Portfolio invests primarily in equity securities of publicly-traded companies with small market capitalizations. Ts plus any borrowings made for investment purposes in all or a representative sample of the stocks in the SP SmallCap 600 Index.

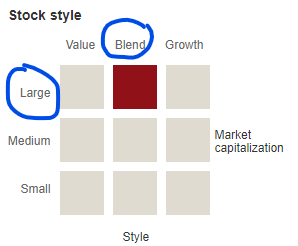

As a consequence small stocks more frequently deliver returns that fail to match benchmarks. It normally invests at least 80 of its assets net asse. The blend style is assigned to portfolios where neither growth nor value characteristics.

Equity market are defined as small-cap. The Best Growth Fund. The Small cap styles represent 9 3 3 3 of the total market.

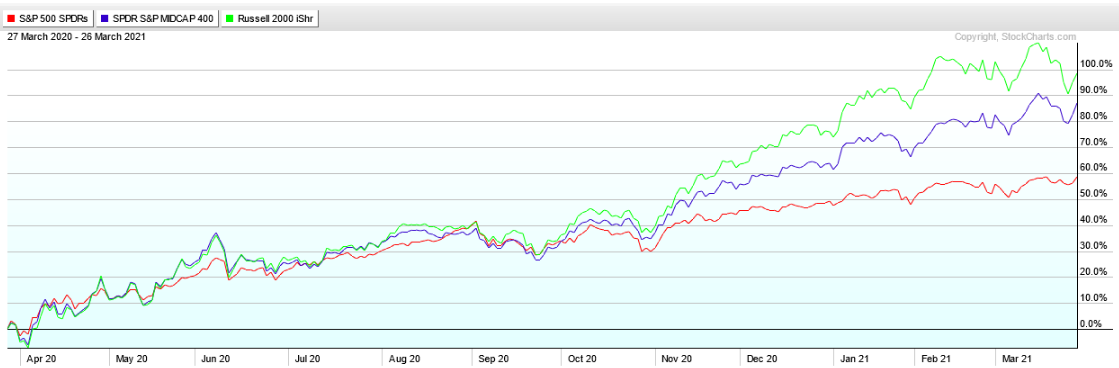

Blend funds also known as. Historically value stocks and small stocks have provided higher returns than large blend and growth stocks in both domestic and foreign markets. The middle is typically identified with Blend which represents that market-capitalization-weighted proxy for all the stocks within that given size range.

Small-blend funds invest in stocks of small companies where neither growth nor value characteristics predominate. Stocks in the bottom 10 of the capitalization of the US. Tilting to Small means overweighting your portfolio to hold more than 9 of Small cap stocks.

For example a large-cap ETF will hold stock in only large-cap companies. Industries with market caps generally between 300 million and 2 billion.

Is It Worth It To Tilt Your Portfolio Towards A Small Cap Investors In Mind And Money

Is It Worth It To Tilt Your Portfolio Towards A Small Cap Investors In Mind And Money

When Is The Best Time To Invest In Small Cap Stocks The Motley Fool

When Is The Best Time To Invest In Small Cap Stocks The Motley Fool

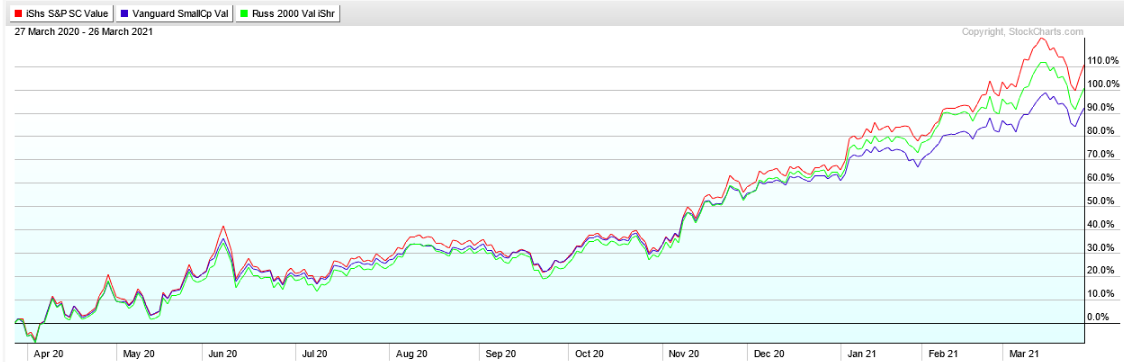

Small Cap Value Likely To Large Cap Growth Nysearca Ijs Seeking Alpha

Small Cap Value Likely To Large Cap Growth Nysearca Ijs Seeking Alpha

Small Cap Growth Portfolio Azzad Asset Management Halal Investment

Small Cap Growth Portfolio Azzad Asset Management Halal Investment

Investment Fundamentals The Mutual Fund Style Box Jrb

Is It Worth It To Tilt Your Portfolio Towards A Small Cap Investors In Mind And Money

Is It Worth It To Tilt Your Portfolio Towards A Small Cap Investors In Mind And Money

Small Cap Value Likely To Large Cap Growth Nysearca Ijs Seeking Alpha

Small Cap Value Likely To Large Cap Growth Nysearca Ijs Seeking Alpha

Small Cap Blend Style 2q17 Best And Worst Lipper Alpha Insight Refintiv

Small Cap Blend Style 2q17 Best And Worst Lipper Alpha Insight Refintiv

Some Recent Fund Style Box Moves Explained Morningstar

Some Recent Fund Style Box Moves Explained Morningstar

:max_bytes(150000):strip_icc()/MutualFundStyleBox2-995a2449c69a430ebc5b3124e95618d5.png) Understanding The Mutual Fund Style Box

Understanding The Mutual Fund Style Box

Small Cap Blend Archives Deep Value Etf Accumulator

Small Cap Blend Archives Deep Value Etf Accumulator

The Small Cap Performance Gap Doesn T Exist Here S Why Seeking Alpha

The Small Cap Performance Gap Doesn T Exist Here S Why Seeking Alpha

Brown Advisory Us Small Cap Blend Fund Sterling C Ie00bbmt2s30

:max_bytes(150000):strip_icc()/StyleBox2-7d4027577e5944749249fa093ef4d35b.png)

Comments

Post a Comment