Featured

Mortgage Rates Per Credit Score

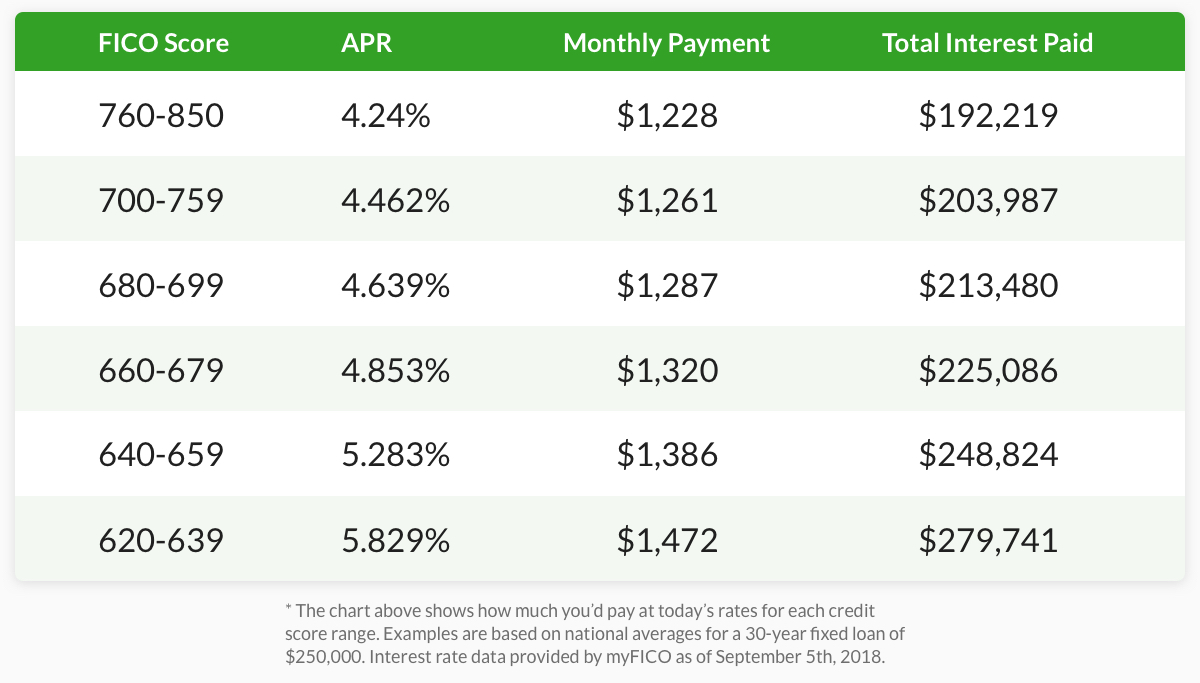

For scores above 620 the APRs above assume a mortgage with 10 points and 80 Loan-to-Value Ratio. In the eyes of banks and lenders this is a below-average credit score.

How Your Credit Score Determines Mortgage Interest Rates

How Your Credit Score Determines Mortgage Interest Rates

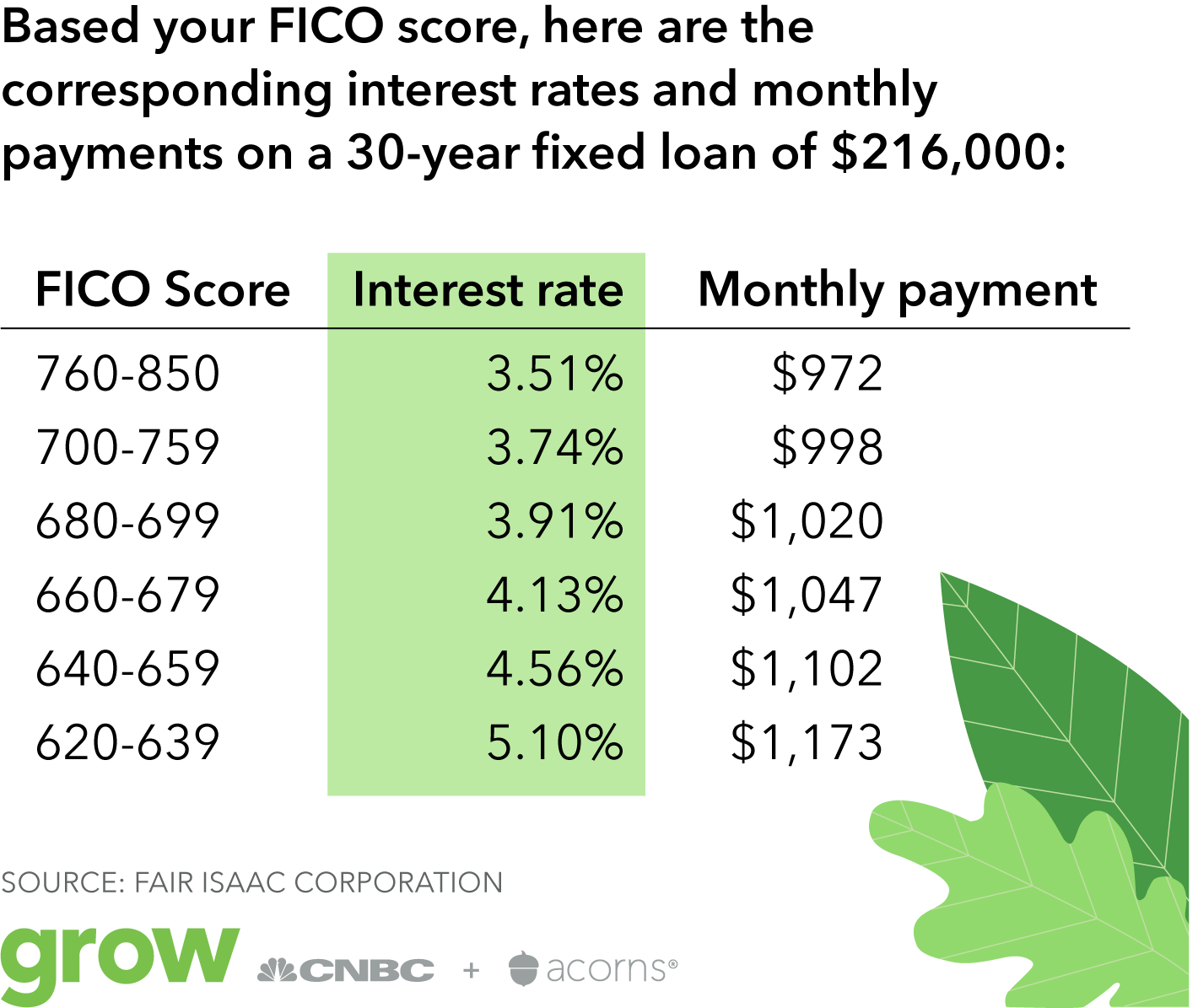

A person with a 760-850 FICO score could secure a 30-year fixed mortgage with a 4147 interest rate.

/how-your-credit-score-influences-your-interest-rate-960278_fin2-6e9a6586481946a4a418afa6d7e2522e.png)

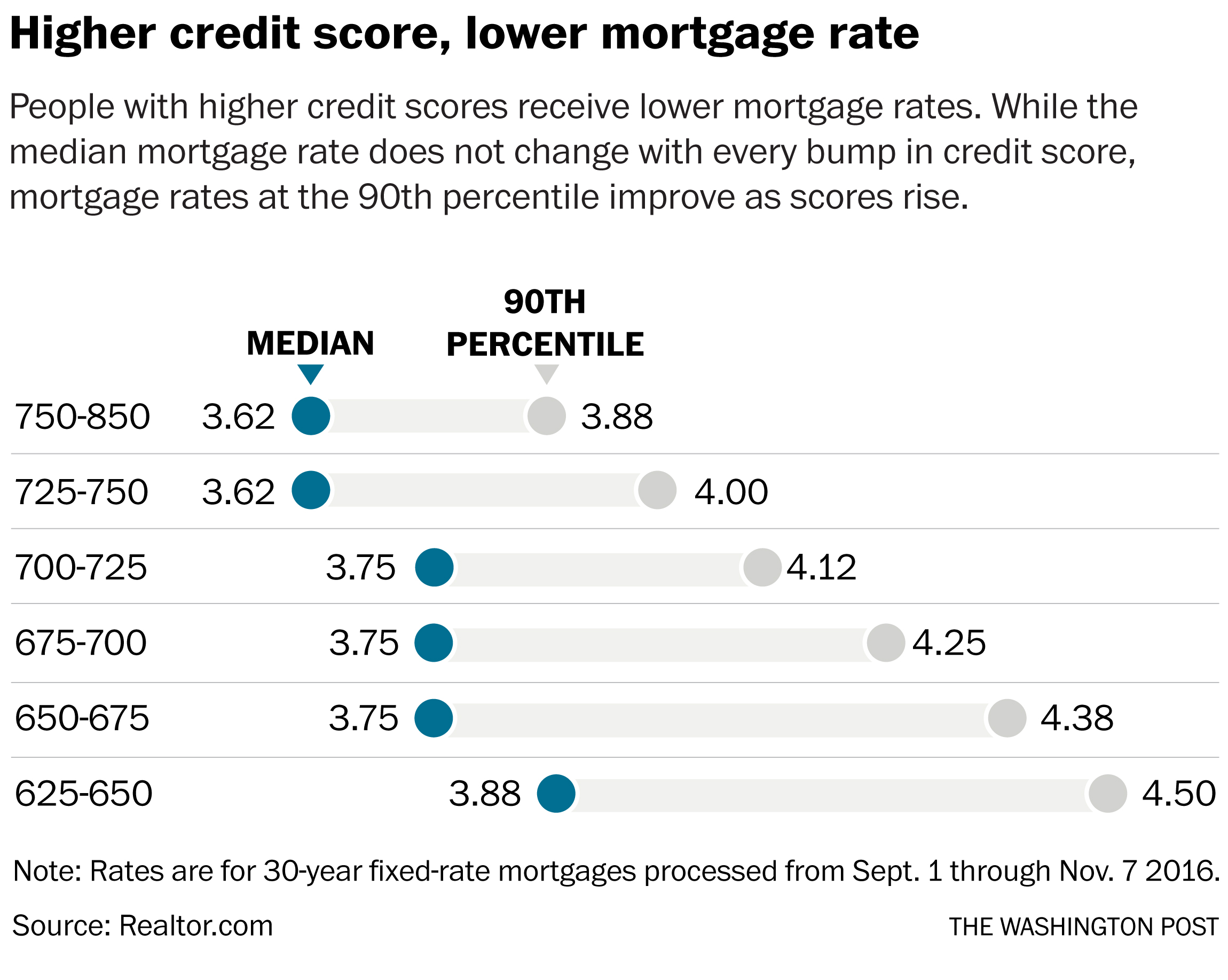

Mortgage rates per credit score. Private mortgage insurance lenders will use your credit history as a determining factor when determining the price of that insurance. Interest rates are based on many factors including where the home is located and the type of mortgage you apply for. For the borrower with a 620 credit score this might equate to an interest rate of say 45 on a 30-year fixed mortgage while the borrower with a 740 score receives a much lower rate of 375.

Excellent credit 720 and above Good credit 660 to 719 Fair credit 620 to 659 Poorbad credit 619 and below. 4 rader Look at the cost adjustment with a 620 credit score. Scores typically range from around 300 to 850 with the average credit score in America being at about 687.

How Credit Reports Affect Your Mortgage. You should receive a very good interest rate on your mortgage and have plenty of options. If your credit score is below 650 your rate could be up at 115 percent per year.

When it comes to conventional financing at least you will be required to have a credit score of at least 620 in order to be eligible for a loan. Assumes mortgage is for a single family owner-occupied property. This rate is more than 06 percentage points lower than the 476 interest rate for a person.

Shoot for a credit score of 620 or above if youre looking for a conventional loan. While mortgage interest rates are currently at an all-time low they drop even lower when your credit score is above 760. Granted credit scores are not the only factor that affect the interest rate.

The difference between getting a mortgage with a 620 credit score and a 760 credit score means 183 on your monthly mortgage payment and 65900 on the total interest paid on the mortgage. How Can You Improve Your Credit Score. As you can tell the interest rate monthly payment and total interest paid all increase as credit scores go down.

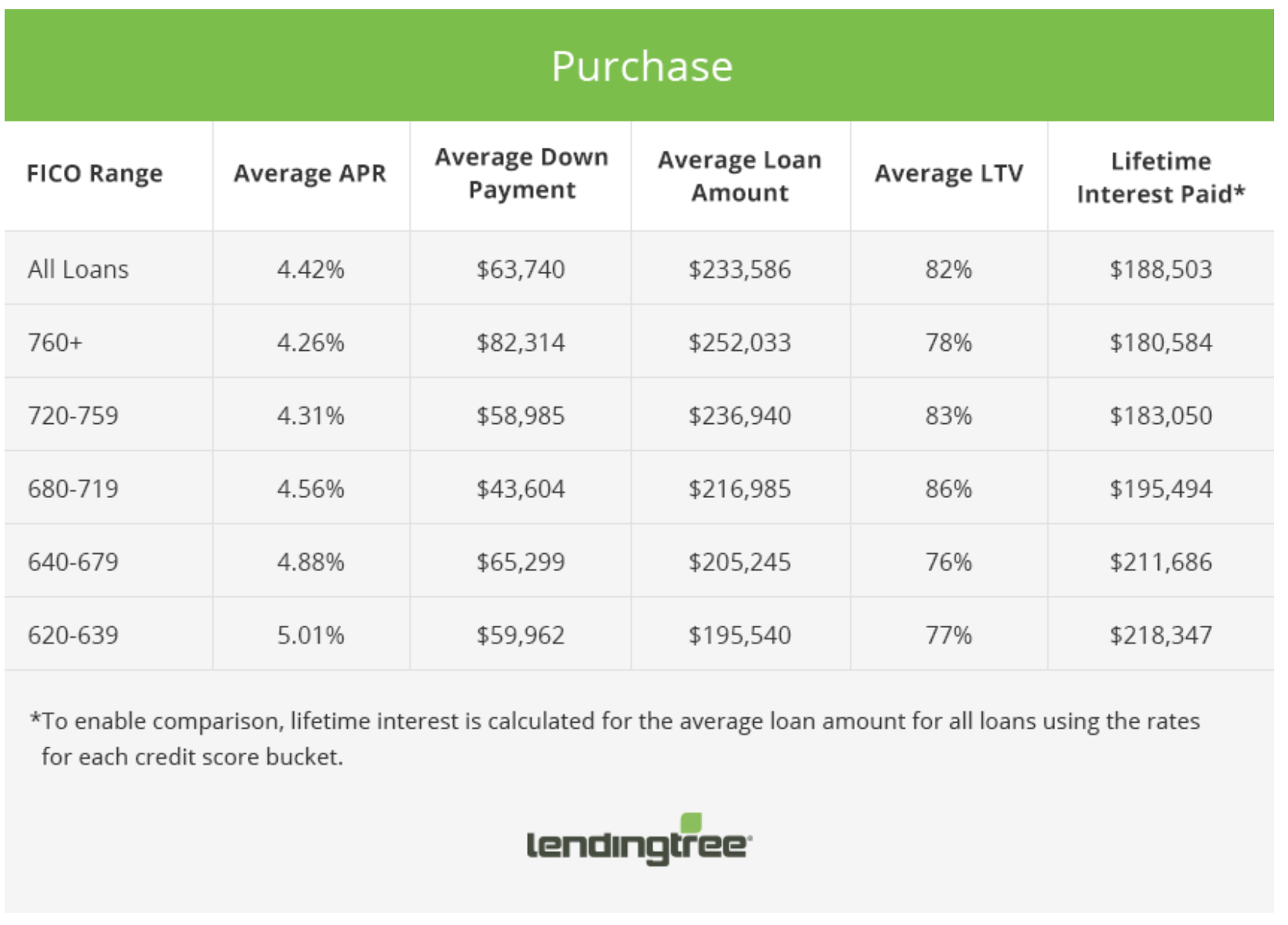

In general a credit score above 670 will allow potential mortgage borrowers access to prime or favorable interest rates on their loan. Your credit scores affect the kinds of mortgages you can be approved for how much you can borrow the mortgage rates youll pay and even how much youll pay for private mortgage insurance. According to FICO the current interest rate for a 30-year fixed mortgage.

Lenders also consider the size of your down payment your debt-to-income ratio and the amount of prepaid interest you pay at closing. Get a great mortgage rate when you compare mortgage rates from multiple lenders choose from fixed rate loans of 15 or 30 year terms or adjustable rate mortgages variable rate loans at 71 ARM 51 ARM and 31 ARM. Here is an approximate range of how credit scores are judged.

For scores below 620 these APRs assume a mortgage with 0 points and 60 to 80 Loan-to-Value Ratio. But credit scores influence mortgage rates the most so they deserve your full attention. Scores below 620 are considered to be subprime and.

7 rader The average mortgage interest rate is 298 for a 30-year fixed mortgage influenced by the. This is considered a fair credit score by lenders. However once you get to 660 youll be entering average credit score territory.

When it comes to getting a mortgage a score of 750 or higher may impress lendersbut your credit score is not the only thing that impacts your approval and what your interest rate will be. A borrower with a very good FICO credit score at least 740 might pay 020 percent to 030 percent of the loan balance for PMI or 50 to 75 a month says Guarino. Conventional loans offer great interest rates and low down payment options.

Below weve outlined the minimum credit scores for each type of mortgage. 160000 X 030 4800 or a 12.

How Your Credit Score Affects Your Mortgage Rates Forbes Advisor

How Your Credit Score Affects Your Mortgage Rates Forbes Advisor

State Of U S Interest Rates Broken Down By Credit Scores Housingwire

State Of U S Interest Rates Broken Down By Credit Scores Housingwire

How Your Credit Score Affects Your Mortgage Rate Chris Doering Mortgage

How Your Credit Score Affects Your Mortgage Rate Chris Doering Mortgage

Financial Planning Mortgage News Blog

Financial Planning Mortgage News Blog

/how-your-credit-score-influences-your-interest-rate-960278_fin2-6e9a6586481946a4a418afa6d7e2522e.png) How A Credit Score Influences Your Interest Rate

How A Credit Score Influences Your Interest Rate

Mortgage Rates And Credit Scores Money Counselor Make Better Money Choices

Current Mortgage Interest Rates May 2021

Current Mortgage Interest Rates May 2021

What Mortgage Rate Can I Get With My Credit Score The Truth About Mortgage

What Mortgage Rate Can I Get With My Credit Score The Truth About Mortgage

How Your Credit Score Can Impact Your Mortgage Rate Frugal Travel Guy

How Your Credit Score Can Impact Your Mortgage Rate Frugal Travel Guy

The Credit Score You Need To Get The Best Rate On A Mortgage

The Credit Score You Need To Get The Best Rate On A Mortgage

Today S Mortgage Interest Rates April 1 2021 Forbes Advisor

Today S Mortgage Interest Rates April 1 2021 Forbes Advisor

Zillow Credit Score Single Most Important Factor For Mortgage Rates The Truth About Mortgage

Zillow Credit Score Single Most Important Factor For Mortgage Rates The Truth About Mortgage

What Mortgage Rate Can I Get With My Credit Score The Truth About Mortgage

What Mortgage Rate Can I Get With My Credit Score The Truth About Mortgage

Comments

Post a Comment