Featured

Is Credit Karma Savings Good

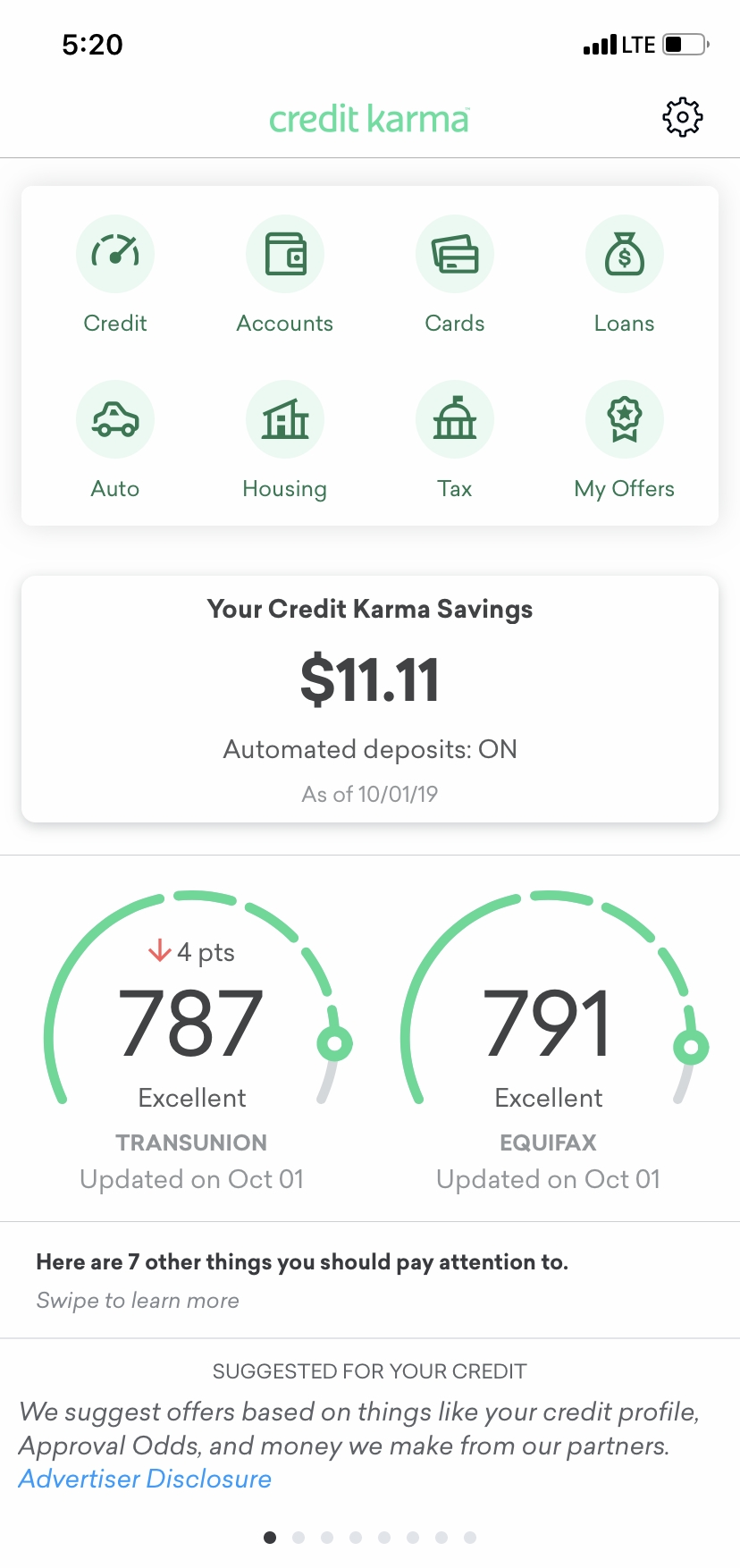

Over the years Credit Karma has expanded its offerings and ventured into other areas of personal finance. In a Nutshell.

Credit Karma Simplifies Savings With High Yield Accounts1 In As Easy As Four Clicks To Get Started Business Wire

Credit Karma Simplifies Savings With High Yield Accounts1 In As Easy As Four Clicks To Get Started Business Wire

Credit Karma is completely free but you must have an existing account to open a Credit Karma Money Save account.

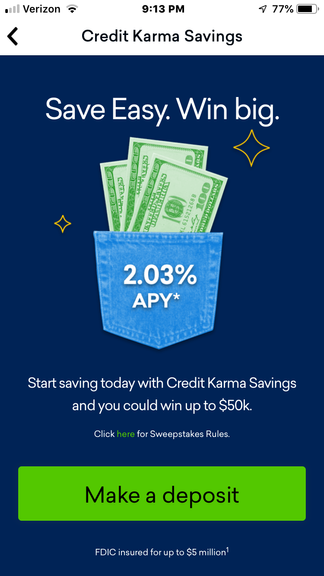

Is credit karma savings good. Credit Karma Savings is a high-yield savings account that currently comes with a 030 APY as of February 2021 which is significantly higher than. CA resident license 0172748. The latest example of this is their Credit Karma Savings product.

So in case you were wondering if Credit Karma is a safe legit and trustworthy company the answer is a resounding yes Credit Karma is safe. It then charges companies to serve you targeted advertisements. Read our full Credit Karma review here.

Most people sign up to Credit Karma just to enjoy the free credit score and credit report and free monitoring service. Once signed up deposits will collect an APY of 030. Credit Karma receives compensation from third-party advertisers but that doesnt affect our editors opinions.

But if you want to save for other financial goals a savings account can be a good. In Savings Accounts from Credit Karma. Credit Karma says it will leverage technology to keep.

Credit Karma is known as a great resource for consumers to monitor their credit. The new feature is the companys first venture into offering bank products to its members. Auto homeowners and renters insurance services offered through Credit Karma Insurance Services LLC dba Karma Insurance Services LLC.

They are most well known for their credit monitoring and credit improvement tools. Credit Karma claims it will take consumers just four clicks to get started. Its at 100 if everybody recommends the provider and at -100 when no one recommends.

Only mortgage activity by Credit Karma Mortgage Inc dba Credit Karma is licensed by the State of New York. Thats much more than the current national average of 005 for savings accounts. Now it even offers a high-yield savings account which happens to be an attractive option for plenty of savers.

The answer is no. But to be fair thats likely by design. They also made a splash with their Credit Karma Tax product which is one of the only free tax software products available.

While its higher than the national average of 004 youll find higher rates with other savings accounts like Chime or Axos High Yield savings which earns 061 APY. After all the service isnt a bank but a general personal finance tool. Credit Karma Savings.

You need a high yield savings account. Credit Karma gives you a free credit score and credit report in exchange for information about your spending habits. Because many savings accounts are insured by the government either the Federal Deposit Insurance Corp.

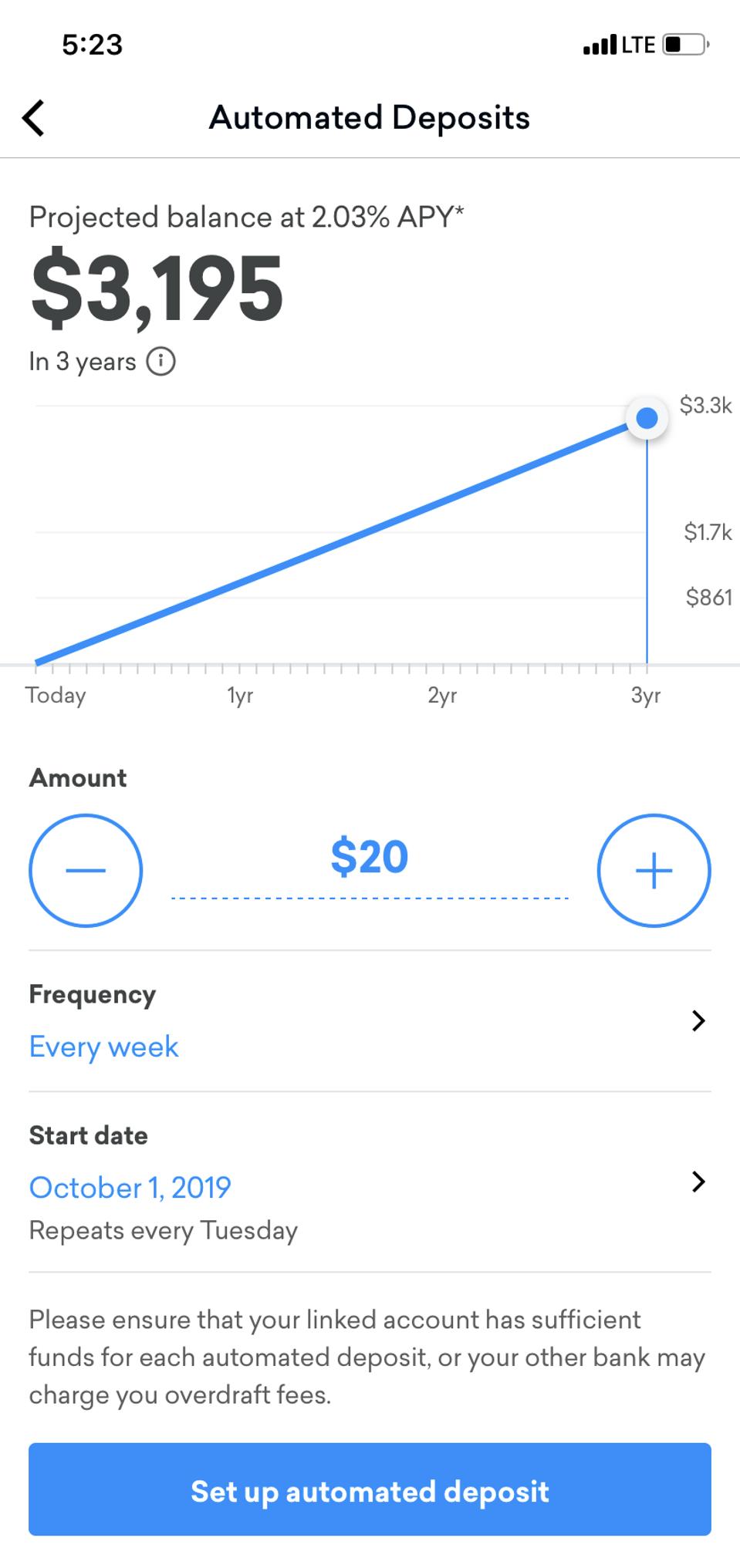

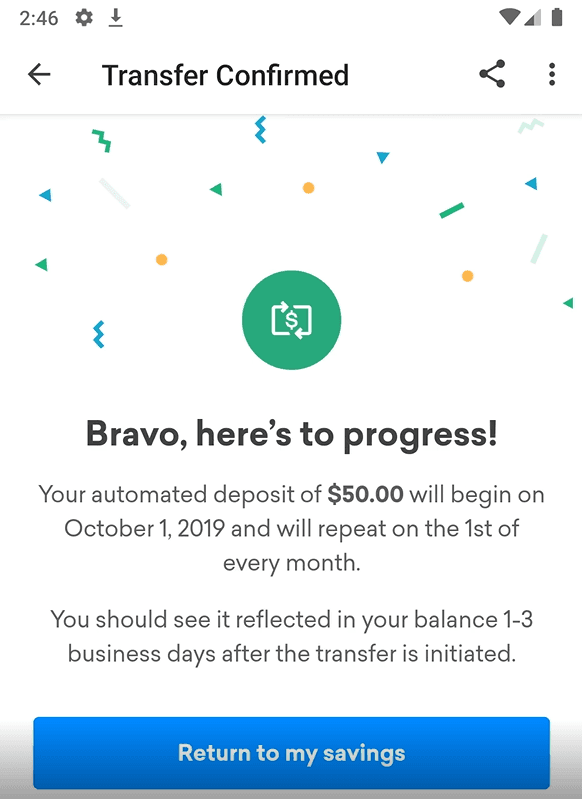

This free account allows users to earn a healthy interest rate currently 130 APY as of March 11th 2020. Therefore its hard to be too upset about a feature that is merely a value-add to a larger ecosystem. Credit Karma is not a bank and this is their first financial savings account product offering.

Interest rates on savings accounts tend to be low so they may not be the best choice for long-term investment goals like retirement. Credit Karma is hardly the first fintech to get. But keep in mind that you dont have to apply for any credit cards or loans.

If you want to earn more for every dollar stashed outside of stocks and bonds a high-yield savings account can be a great place to start. Recommendation score measures the loyalty between a provider and a consumer. Accountholders can make one-time deposits or arrange for.

Credit Karma Money Save is about as basic of a banking account as you can get. Check out my Credit Karma Savings Account Review to see if Credit Karma Savings is the right one for you69 of Ameri. Credit Karma Savings is a high-yield savings account that is accessible through the companys app.

This product is mostly recommended by SuperMoney users with a score of 18 equating to 34 on a 5 point rating scale. Or the National Credit Union Administration they can be a good place to keep your cash until you need it. Many people ask if getting your credit score from Credit Karma will damage your credit.

Final Thoughts on Credit Karma Savings.

Credit Karma Review Get Your Free Credit Score Pt Money

Credit Karma Review Get Your Free Credit Score Pt Money

Credit Karma Launches High Yield Savings Account

Credit Karma Launches High Yield Savings Account

Credit Karma Savings Account Review Magnifymoney

Credit Karma Savings Account Review Magnifymoney

Credit Karma Launches High Yield Savings Account The Dough Roller

Credit Karma Launches High Yield Savings Account The Dough Roller

Credit Karma High Yield Savings Accounts Making Money Work For You

Credit Karma High Yield Savings Accounts Making Money Work For You

Credit Karma Savings High Apy No Monthly Fees

Credit Karma Savings Offers One Of The Highest Interest Rates At 1 75 Business Insider

Credit Karma Savings Offers One Of The Highest Interest Rates At 1 75 Business Insider

Credit Karma Savings Account Review 2019 Youtube

Credit Karma Savings Account Review 2019 Youtube

Credit Karma High Yield Savings Account Review 2021 Mybanktracker

Credit Karma High Yield Savings Account Review 2021 Mybanktracker

Credit Karma Launches A New Savings Account With 1 90 Apy

Credit Karma Launches A New Savings Account With 1 90 Apy

Credit Karma Unveils New High Yield Savings Accounts Finovate

Credit Karma Unveils New High Yield Savings Accounts Finovate

Credit Karma Launches A New Savings Account With 1 90 Apy

Credit Karma Launches A New Savings Account With 1 90 Apy

Credit Karma Savings Offers One Of The Highest Interest Rates At 1 75 Business Insider

Credit Karma Savings Offers One Of The Highest Interest Rates At 1 75 Business Insider

Comments

Post a Comment