Featured

- Get link

- X

- Other Apps

Government Bond Etf

IShares Govt Bond 0-1yr UCITS ETF EUR Dist iShares Govt Bond 0-1yr UCITS ETF EUR Dist iShares Govt Bond 0-1yr UCITS ETF EUR Dist Fixed Income. BNDX - Vanguard Total International Bond ETF BWX - SPDR Bloomberg Barclays International Treasury Bond ETF.

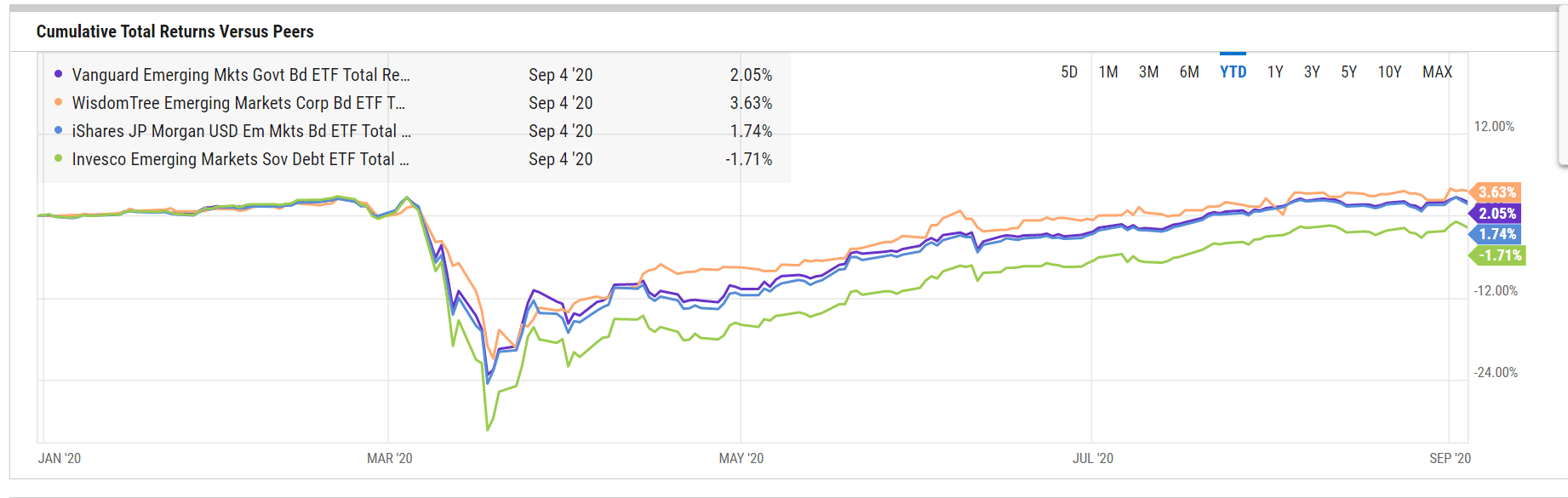

Vanguard Emerging Markets Government Bond Etf Riding The Weak Dollar To New Highs Nasdaq Vwob Seeking Alpha

Vanguard Emerging Markets Government Bond Etf Riding The Weak Dollar To New Highs Nasdaq Vwob Seeking Alpha

Short-dated government bonds yield very little 01 for a two-year bond while longer dated maturities have a higher yield but offer significantly less income than they did in the past.

Government bond etf. Therefore the value of these securities are sensitive to movements in interest rates. One simple low-cost way is with a government bond ETF. The Fund invests in fixed interest securities such as corporate or government bonds which pay a fixed or variable rate of interest.

Treasury exchange-traded funds ETFs provide investors with a way to gain exposure to the US. IShares Core Total USD Bond Market ETF. Access 3000 ETFs from 30 Exchanges around the World.

Annonse Trade ETFs With Plus500. The ETF invests in physical index securities. Access 3000 ETFs from 30 Exchanges around the World.

As a result a short-duration bond ETF like BSV acts as a better hedge to rising rates. 72 of retail lose money. These are similar to bond mutual funds because they hold a portfolio of bonds with.

Annonse Commissions From USD 3. Annonse Trade ETFs With Plus500. The Bank of England unlike Eurozone member states can simply create new money to finance the governments obligations.

Annonse Commissions From USD 3. Government Bond Funds and ETFs invest primarily in bonds and other debt instruments issued by federal state and local governmentsThe funds in this category may invest in bonds with short- intermediate- or long-term. 72 of retail lose money.

Discover a more intuitive way of trading. Where there are governments there are usually government bonds. CFD Platform- No Commission.

Government bonds take about 6673 of the fund with A-rated and Baa-rated bonds. In terms of the available exchange traded funds investors can purchase short-dated gilts ETFs covering the entire range of maturities and long-dated gilts. Typically when interest rates rise there is a corresponding decline in the market value of bonds.

Heres a list of some international bond ETFs. Fast Reliable Access. 15 rader Long Term Government Bond ETFs provide investors with exposure to the.

IShares Floating Rate Bond ETF. Fast Reliable Access. 27 rader Government Bonds ETFs offer investors exposure to fixed income securities issued by government.

Bond exchange-traded funds ETFs are a type of exchange-traded fund ETF that exclusively invests in bonds. IShares 3-7 Year Treasury Bond ETF. You can click on the links for some of these symbols for more information.

The Barclays Euro Treasury Bond Index offers exposure to Euro denominated investment grade government bonds publicly issued in the Eurobond and Euro zone domestic markets. Government bond market through investing in. Government bonds are debt issued by sovereign governments such as the UK the US Japan India and so on.

Discover a more intuitive way of trading. CFD Platform- No Commission.

Bond Etf Meaning Examples Top 3 Types Of Bond Etfs

Bond Etf Meaning Examples Top 3 Types Of Bond Etfs

How To Find The Best Bond Etfs For Client Portfolios Ycharts

How To Find The Best Bond Etfs For Client Portfolios Ycharts

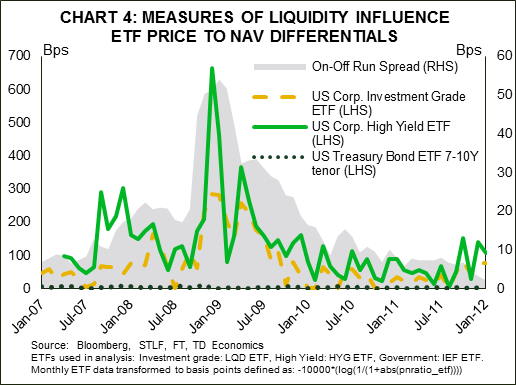

Bond Etfs A Liquid Pool Of Illiquid Assets

Bond Etfs A Liquid Pool Of Illiquid Assets

Bond Etfs For European Index Investors Bankeronwheels Com

Bond Etfs For European Index Investors Bankeronwheels Com

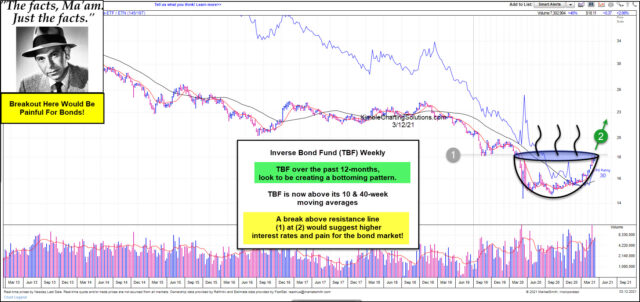

Government Bond Bear Market About To Get Worse Investing Com

Government Bond Bear Market About To Get Worse Investing Com

15 Years Of Bond Etf History In A Nutshell Etf Com

15 Years Of Bond Etf History In A Nutshell Etf Com

An Introduction To Government Bond Etfs Justetf

An Introduction To Government Bond Etfs Justetf

The 3 Biggest Treasury Bond Etfs And How To Use Them Nasdaq

The 3 Biggest Treasury Bond Etfs And How To Use Them Nasdaq

An Introduction To Government Bond Etfs Justetf

An Introduction To Government Bond Etfs Justetf

Bonds Vs Bond Etfs What Are The Differences And Benefits Zegal

Bonds Vs Bond Etfs What Are The Differences And Benefits Zegal

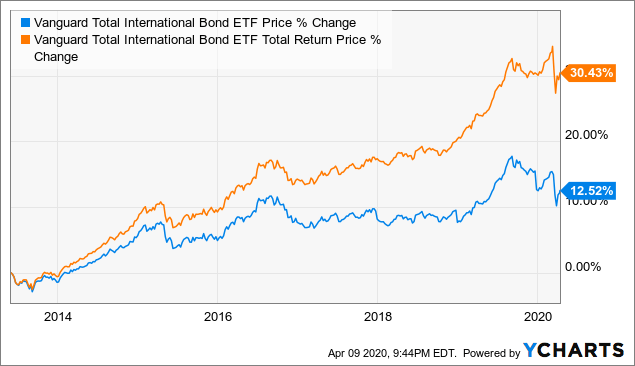

Vanguard Total International Bond Etf Should Outperform When The Threat Of Covid 19 Recedes Nasdaq Bndx Seeking Alpha

Vanguard Total International Bond Etf Should Outperform When The Threat Of Covid 19 Recedes Nasdaq Bndx Seeking Alpha

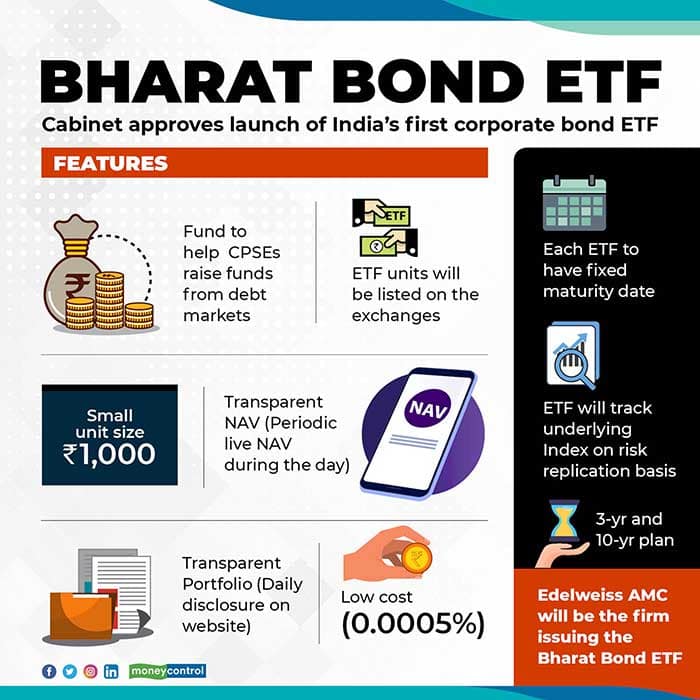

Bharat Bond Etf First Cut The Nitty Gritty Of The Government S Debt Offering

Bharat Bond Etf First Cut The Nitty Gritty Of The Government S Debt Offering

Bond Etf How To Pick A Great Bond Fund The Motley Fool

Bond Etf How To Pick A Great Bond Fund The Motley Fool

Government And Treasury Bond Etfs Struggle In Q4

Government And Treasury Bond Etfs Struggle In Q4

Comments

Post a Comment