Featured

- Get link

- X

- Other Apps

Special Purpose Acquisition Company List

Represented Ribbit LEAP Ltd. This guidance provides the Division of Corporation Finances views about certain disclosure considerations for special purpose acquisition companies commonly referred to as SPACs in connection with their initial public offerings and.

On 3292021 the company announced a pending merger with Cazoo the UKs leading online car retailer.

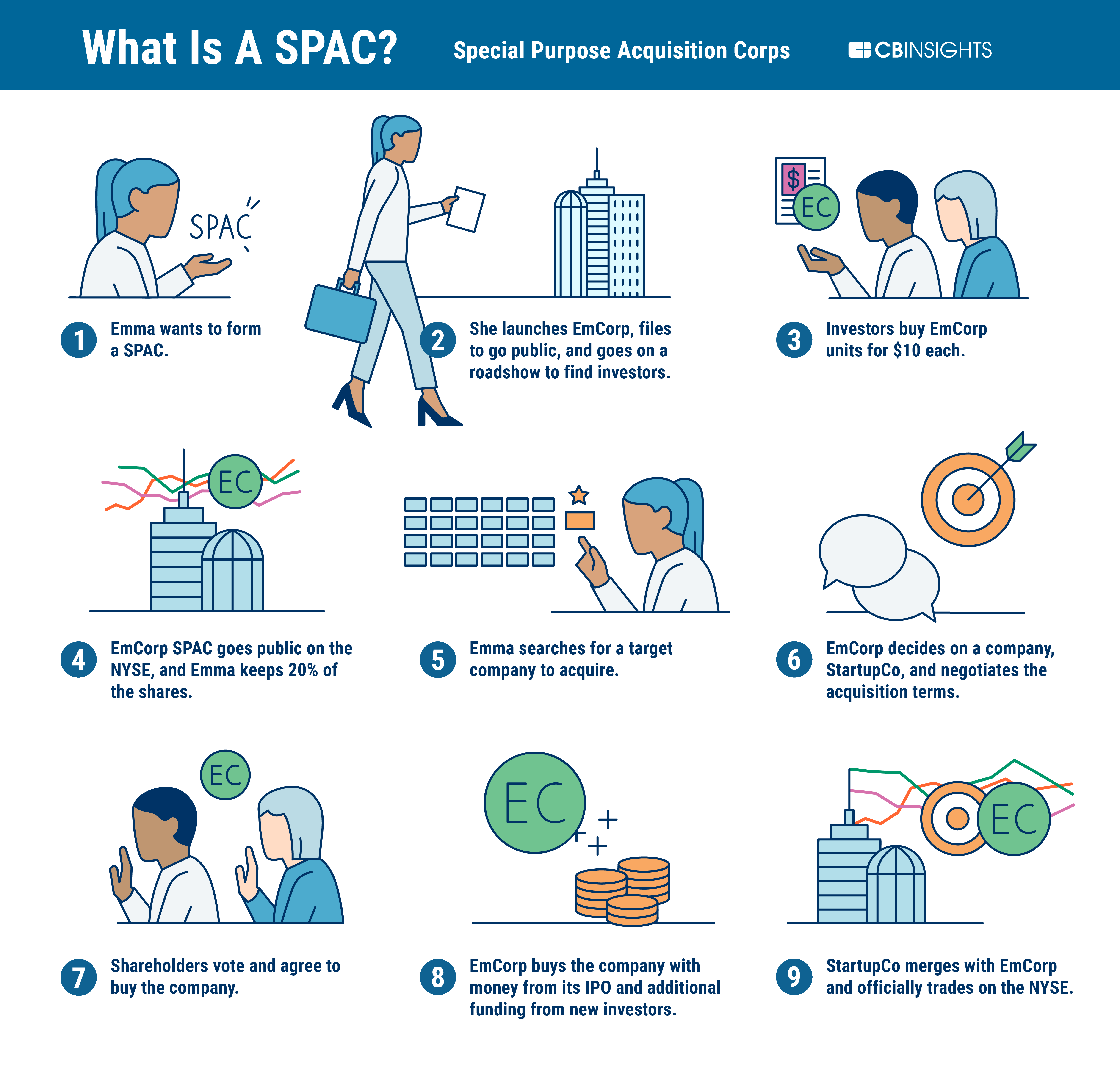

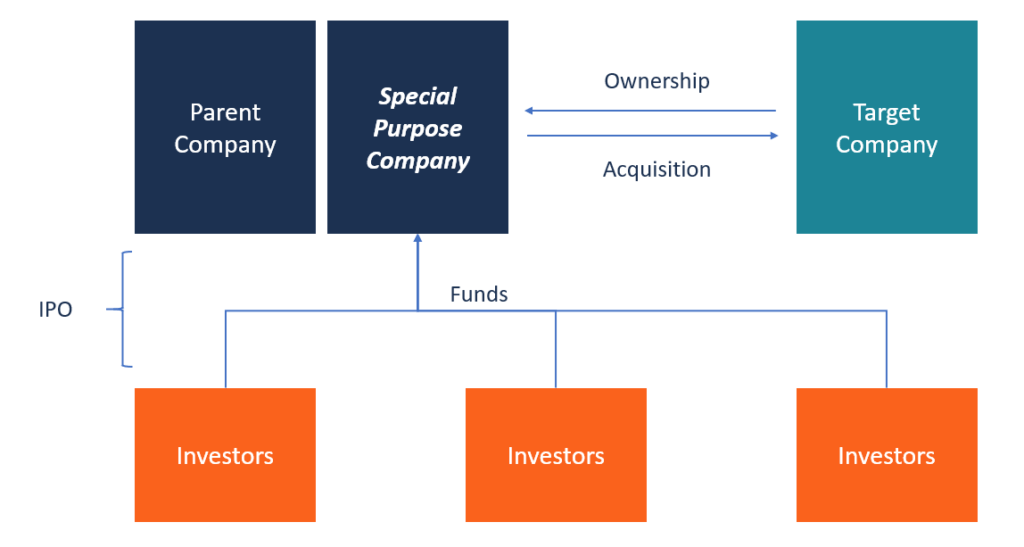

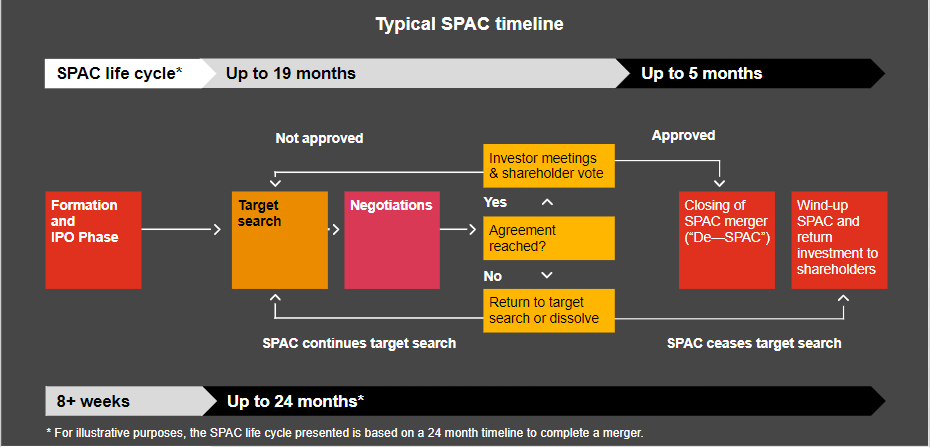

Special purpose acquisition company list. A SPAC is an investment vehicle allowing the public to invest in companies or industry sectors normally sought by private equity firms. A special purpose acquisition company SPAC is a company with no commercial operations that is formed strictly to raise capital through an initial public offering IPO for the purpose of. A special purpose acquisition company SPAC is essentially a shell corporation whose sole purpose is to raise money to acquire one or more businesses or assets.

In its 330 million SPAC IPO and Nasdaq listing. 526 rows List of Shell Companies or Special Purpose Acquisition Companies SPACs There are. FEAC Conyers Park II Acquisition NASDAQ.

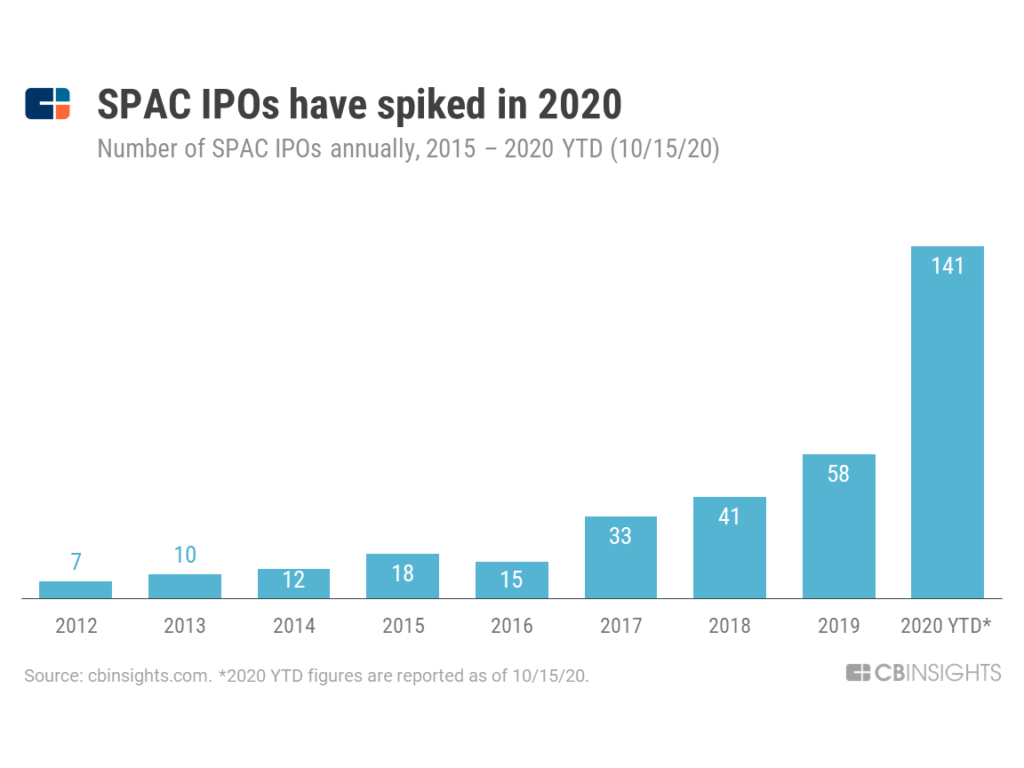

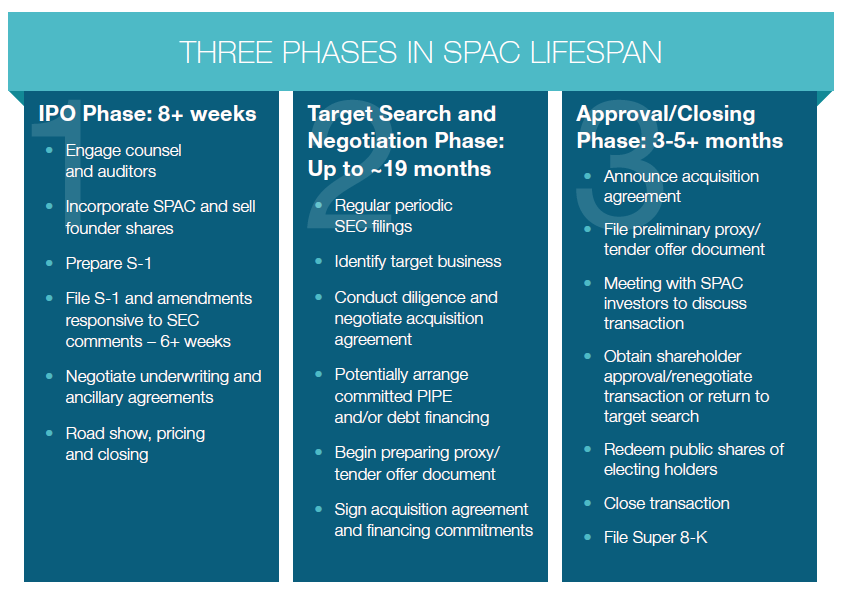

And that focus could soon involve IT distributors MSP software providers and cloud computing companies that work closely with VARs ChannelE2E believes. Represented Qell Acquisition Corp. Special Purpose Acquisition Companies SPACs continue to be increasingly popular vehicles for entities or individuals to raise capital to pursue merger opportunities and for private companies seeking to raise capital obtain liquidity for existing shareholders and become publicly traded.

Represented Vy Global Growth in its 500 million SPAC IP and NYSE listing. Special Purpose Acquisition Companies SPACs are companies formed to raise capital in an initial public offering IPO with the purpose of using the proceeds to acquire one or more unspecified businesses or assets to be identified after the IPO. 114 rows 27 February 2021.

Special purpose acquisition companies SPACs also known as blank-check firms continue to expand their focus across the technology market. Analysis includes total gross proceeds announcement deadline date and number of months left until deadline held in trust and list of symbols for all trading securities included in the unit. This acquisition is accomplished through a reverse merger or a purchase agreement.

Class A 259900000 01142021 On 172021 the company announced a pending merger with Achronix. Some people refer to these as SPAC stocks. A special purpose acquisition company SPAC is formed for the purpose of raising capital through an IPO and using those funds to acquire an operating business.

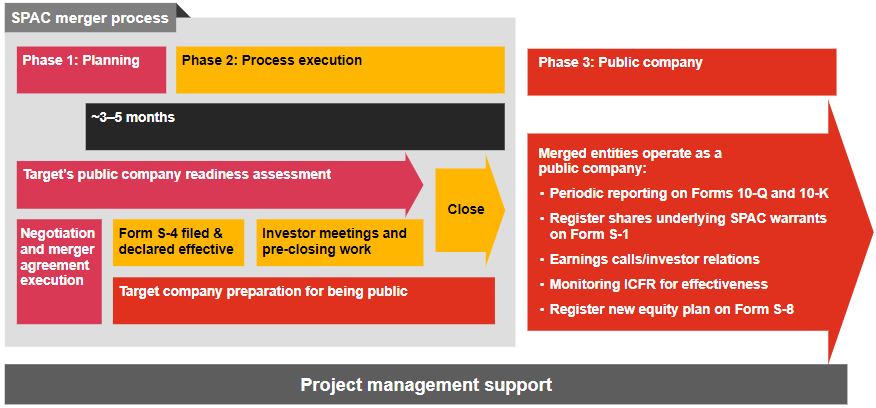

This post provides an update to SPAC structures and transactions since a 2018 post Special Purpose. Special Purpose Acquisition Corporation SPAC The Special Purpose Acquisition Corporation SPAC program offers an alternative vehicle for listing on TSX. Upon completing a business.

Represented Prime Impact Acquisition I in its 300 million SPAC IPO and NYSE listing. CPAA Social Capital Hedosophia Holdings Corp. SPACs are acquisition companies listed under IM-5101-2 and as such would be exempt from the rules in this proposal until they complete a business combination.

List of SPACS Special Purpose Acquisition Company With Pending Mergers Symbol Name Market cap Date Added Proposed Merger Momentum factor 10 Momentum factor 200 Shares outstanding Average trading volume traded Action ACEV ACE Convergence Acquisition Corp. A download-able weekly list of all SPAC Special Purpose Acquisition Company IPO transactions. First out of the gate was Altimar Acquisition a 275 million SPAC that closed a deal in December with asset managers Owl Rock and Dyal to combine.

Division of Corporation Finance Securities and Exchange Commission CF Disclosure Guidance. On its 350 SPAC IPO and NYSE listing. 130 rows List of Special Purpose Acquisition Companies With Pending Mergers.

NKLA Churchill Capital Corp. Flying Eagle Acquisition NYSE. SPACs bring together experienced management teams often comprising industry veterans private equity sponsors or other financing experts who can leverage their expertise to raise capital.

On 462021 the company announced a pending merger with Topps the trading card company. A special purpose acquisition. Target companies are usually privately held.

What Are Spacs The Trend In 2020 Cb Insights Research

What Are Spacs The Trend In 2020 Cb Insights Research

Nasdaq Bets On Blank Check Co Ipo To Boost Listings Spacs Are Sizzling

Nasdaq Bets On Blank Check Co Ipo To Boost Listings Spacs Are Sizzling

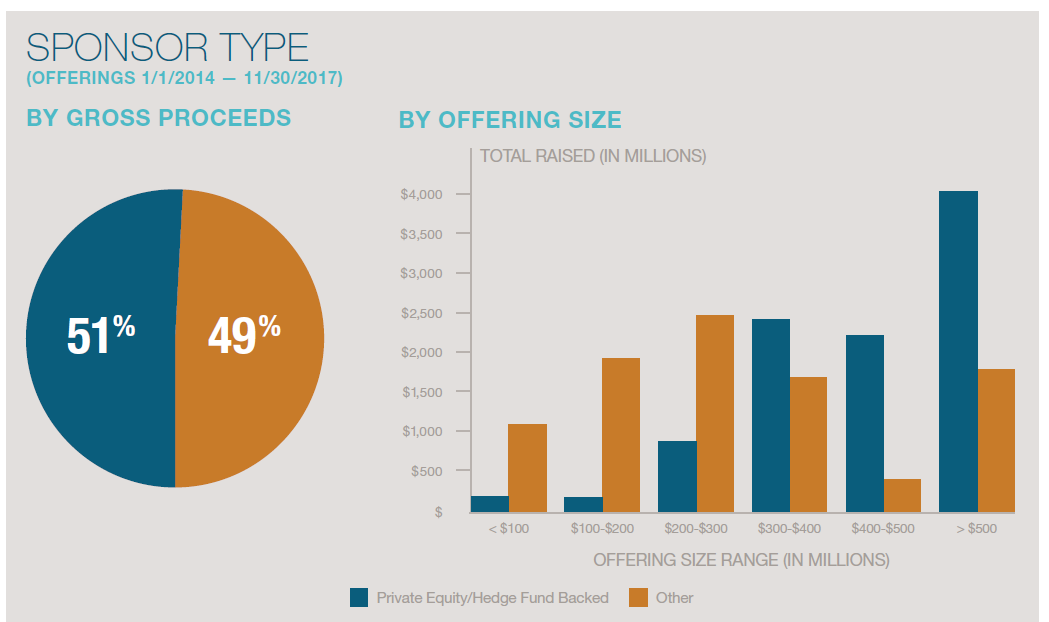

Us Special Purpose Acquisition Companies Build Their Buying Power S P Global Market Intelligence

Us Special Purpose Acquisition Companies Build Their Buying Power S P Global Market Intelligence

Top 10 Frequently Asked Questions About Spacs Special Purpose Acquisition Company Best Engaging Communities

Top 10 Frequently Asked Questions About Spacs Special Purpose Acquisition Company Best Engaging Communities

A Record Pace For Spacs Nasdaq

A Record Pace For Spacs Nasdaq

Special Purpose Acquisition Companies An Introduction

Special Purpose Acquisition Companies An Introduction

What Are Spacs The Trend In 2020 Cb Insights Research

What Are Spacs The Trend In 2020 Cb Insights Research

What Is A Special Purpose Acquisition Company And Why Are Companies Going Public Via Spacs Investeek

What Is A Special Purpose Acquisition Company And Why Are Companies Going Public Via Spacs Investeek

Spac Listings On Nasdaq Spac Structure Investment

Spac Listings On Nasdaq Spac Structure Investment

Top Spac Listings And How To Invest

Top Spac Listings And How To Invest

Special Purpose Acquisition Company Spac Overview How It Works

Special Purpose Acquisition Company Spac Overview How It Works

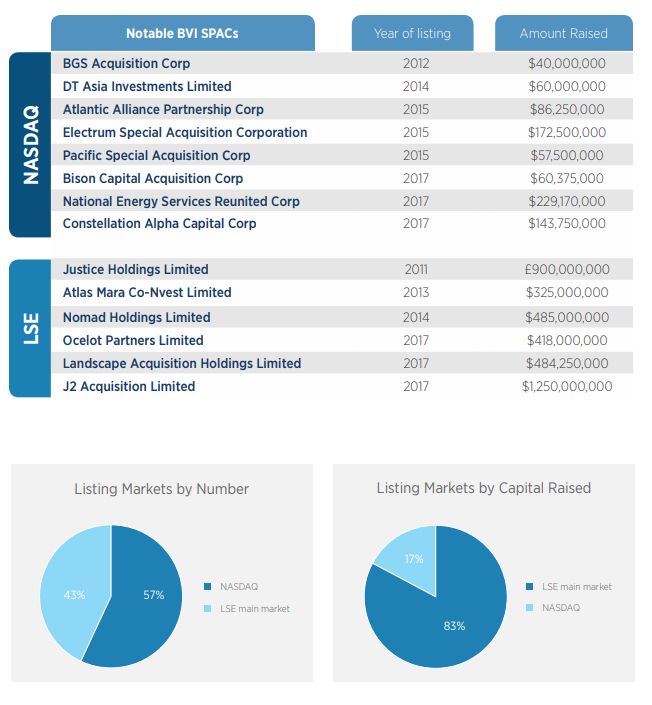

The Rise Of Bvi Special Purpose Acquisition Companies Corporate Commercial Law Bermuda

The Rise Of Bvi Special Purpose Acquisition Companies Corporate Commercial Law Bermuda

Special Purpose Acquisition Companies An Introduction

Special Purpose Acquisition Companies An Introduction

Comments

Post a Comment