Featured

Etf Tax Benefits

When compared to traditional mutual funds this is generally true. From the perspective of the IRS the tax treatment of ETFs and mutual funds are the same.

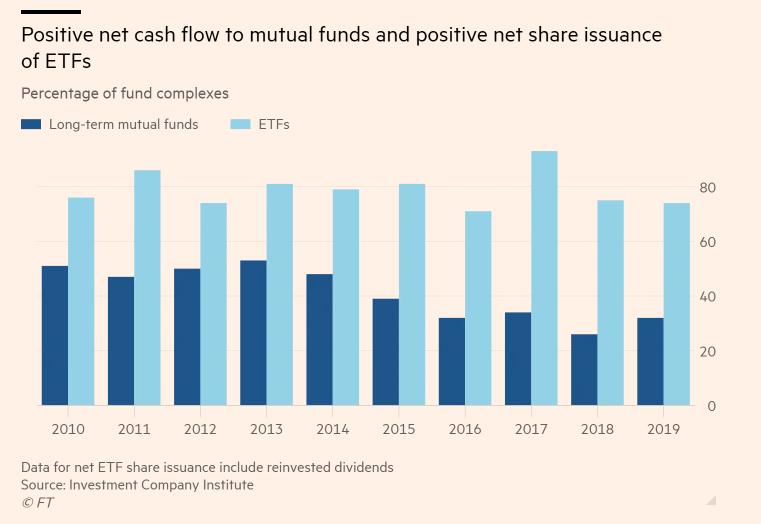

Tax Advantages Are Driving Investors From Mutual Funds To Etfs

Tax Advantages Are Driving Investors From Mutual Funds To Etfs

ETFs can be more tax efficient compared to traditional mutual funds.

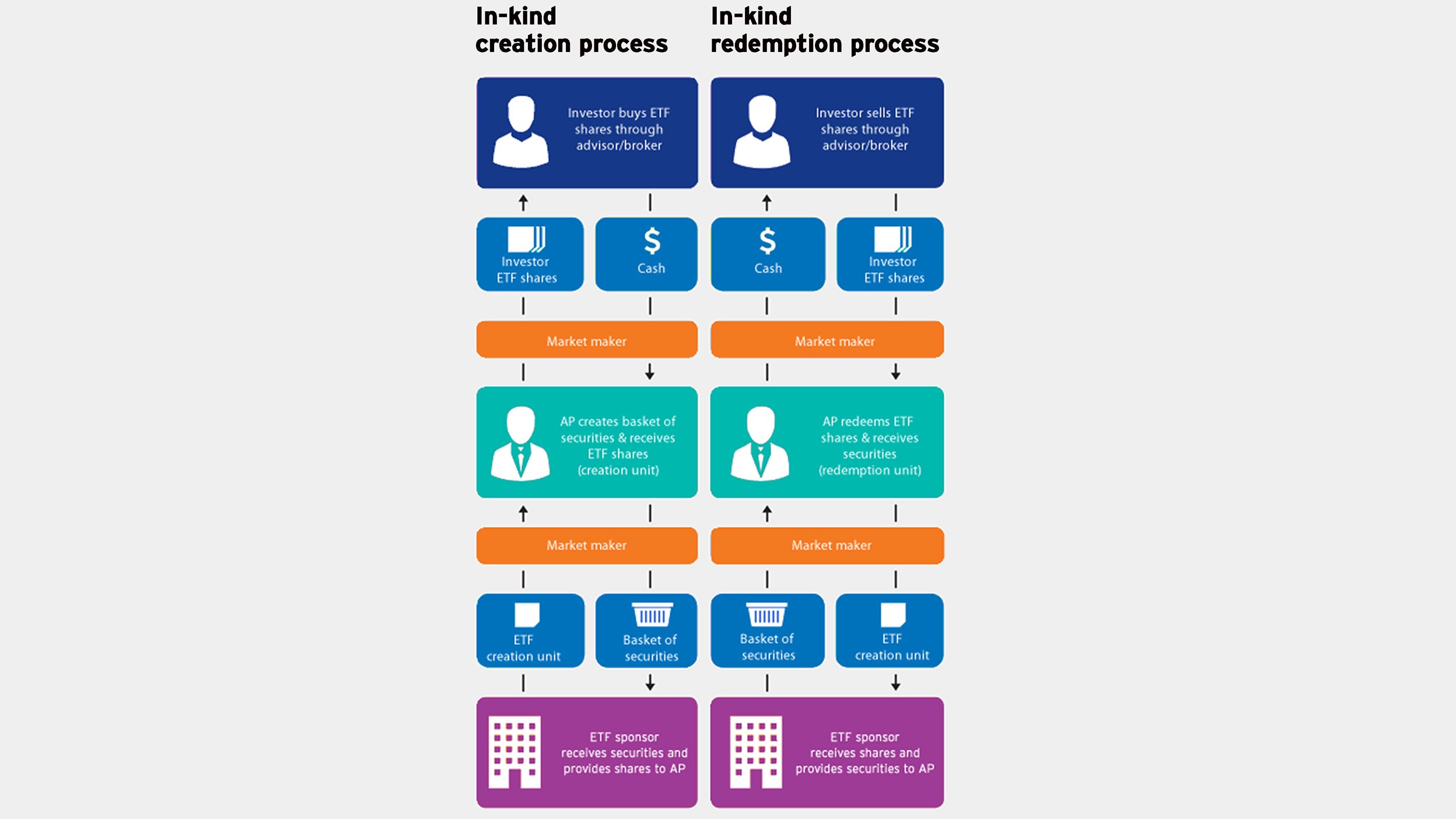

Etf tax benefits. As ETFs use a primary market for creation and redemption in exchange for a basket of securities and benefit from not needing to trade securities as frequently as active funds they avoid having to pay extra taxes on capital gains which mutual funds would incur by selling appreciated securities. Mutual fund capital gains taxes typically accumulate and are imposed on fund holders annually. Overall ETFs are similar to.

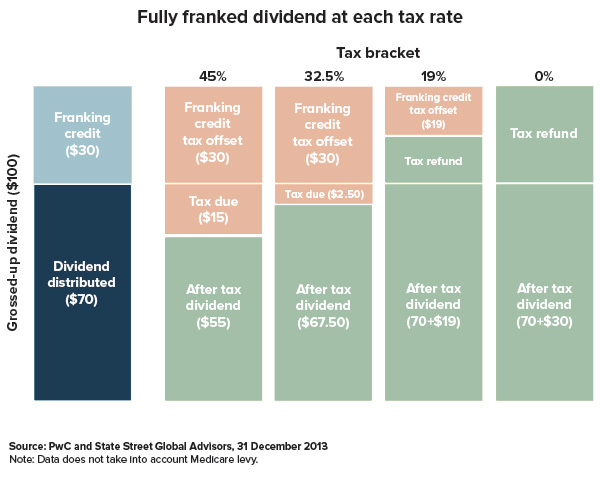

Federal withholding tables are subject to changes by the Internal Revenue Service. Although the ETF might give the holder the benefits of diversification it has the trading. Typically that means anywhere from 12501 to 17500 in the tax year 2020-21.

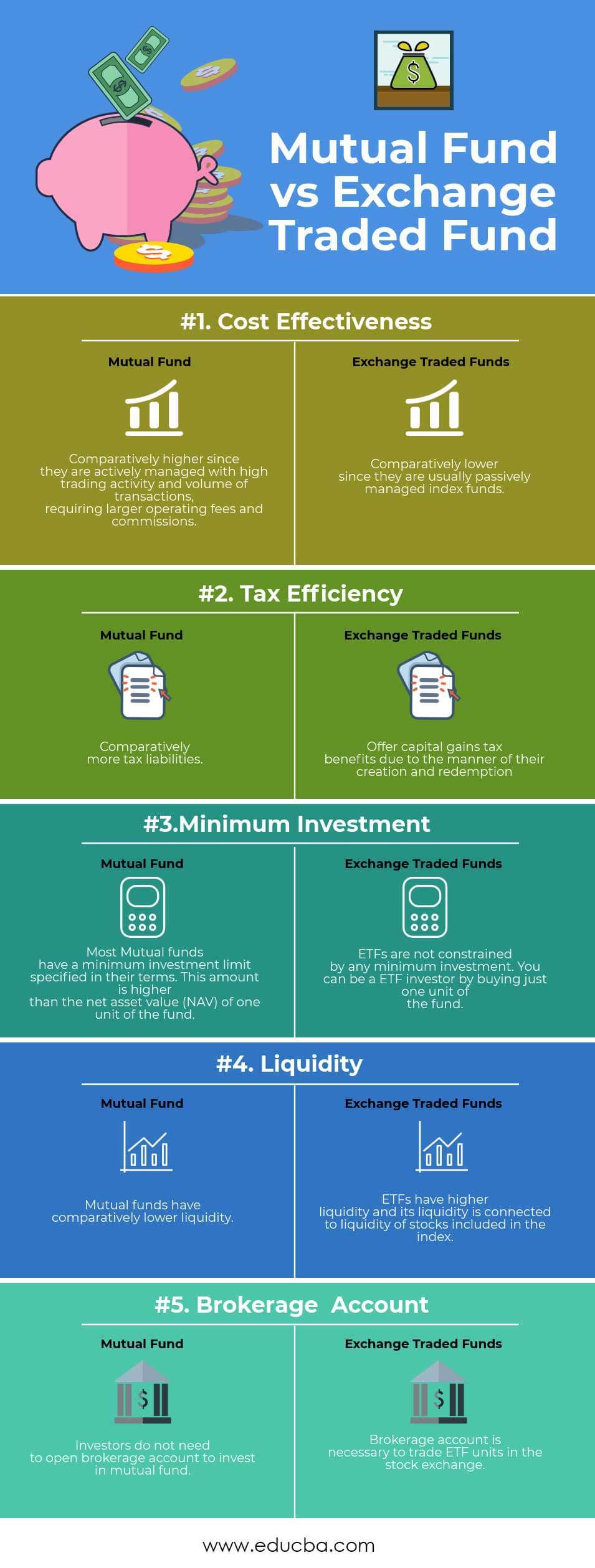

Both are subject to capital gains tax and taxation of dividend income. ETF Taxes. ETFs enjoy a more favorable tax treatment than mutual funds due to their unique structure.

If youve researched ETFs at all youve probably seen them referred to as a tax-friendly investment. An ETF can track a. For Stockspot clients we calculate your tax liability for you including any.

Greater Tax Efficiency ETFs are vastly more tax efficient than competing mutual funds. Consult with your professional tax advisor or visit irsgov for the latest information. With ETFs capital gains and taxes are generally recognized only upon sale.

Mutual funds are typically more actively traded than ETFs and each trade invites an opportunity for capital gains taxes. ETFs are more tax efficient than mutual funds. Assuming an ETF and a mutual fund have the same total return the ETF will grow at a faster pace.

ETFs create and redeem shares with in-kind transactions that are not considered sales. Below are common events and how they are treated within the ETF structure. Advantages of ETFs Diversification.

If you earn taxable bond ETF interest that falls within this 0 tax band then it may not be liable for income tax. The Starting Rate for Savings protects interest earned in the income band that lies up to 5000 above your Personal Allowance. One of the benefits investors in ETFs have historically enjoyed is strong tax efficiency.

This means that tax is only paid on half of the capital gain. The control and tax benefits of ETFs Exchange Trade Funds are attracting more investment dollars while mutual funds are drawing few dollars. Generally holding an ETF in a taxable account will generate less tax liabilities than if you held a similarly structured mutual fund in the same account.

One ETF can give exposure to a group of equities market segments or styles. The ETF market in the US however was praised for its tax benefits compared to those for mutual funds. Where youve owned an ETF for 12 months the law allows the taxable capital gain to be reduced by 50 for individuals.

Typically handled in-kind with transactions and generally not taxable for the ETF and its shareholders. Have ETF withhold the right amount of money from your monthly benefit payment. If a mutual fund or ETF holds securities that have appreciated in value and sells them for any reason they.

Most retirement payments are subject to federal and state taxes. LTCG Any LTCG from debt gold or international ETFs will be taxed at 20 with indexation benefits STCG Any STCG from debt gold or international ETFs will be added to the investors annual income and taxed as per the applicable income tax slab rates Reduce Tax Liability by Setting Off Capital Losses Arising from the Sale of an ETF. Exactly how much an investor benefits after-tax depends on their marginal tax rate the return of the investment and how long they hold the investment.

Trades Like a Stock. Based on the initial forecasts from the top three asset managers 2020 has continued that trend.

How Sovereign Gold Bonds Hold Up Against Gold Etfs And Funds

How Sovereign Gold Bonds Hold Up Against Gold Etfs And Funds

Etf Top Exchange Traded Funds Benefits Of Investing In Etf Paisabazaar

Etf Top Exchange Traded Funds Benefits Of Investing In Etf Paisabazaar

What Are Exchange Traded Funds Etf In India A Guide Scripbox

What Are Exchange Traded Funds Etf In India A Guide Scripbox

.jpg) Explore What Are The Benefits Of Etfs Mutual Funds Sahi Hai

Explore What Are The Benefits Of Etfs Mutual Funds Sahi Hai

Mutual Fund Vs Exchange Traded Fund Which One Is Better

Mutual Fund Vs Exchange Traded Fund Which One Is Better

/exchange-traded-fund-concept-1142584616-f7bfe2d5266b4811aa6a32e5063c5e0b.jpg) Etf Tax Advantages Over Mutual Funds

Etf Tax Advantages Over Mutual Funds

Comments

Post a Comment