Featured

Growth Of Life Insurance

The Teenager Life Insurance market research report added by Report Ocean is an in-depth analysis of the latest developments market size status upcoming technologies industry drivers challenges regulatory policies with key company profiles and strategies of players. Life Insurance is precisely planned to protect your legatee financially should something unfortunate happen to you.

Cash-value life insurance usually has a level premium in which money doled out to cash decreases over time and money.

Growth of life insurance. New business premiums of life insurance companies grew at 17 percent in Julythe slowest pace in five months. This is not the case with life insurance. The new regulations will protect the customer and support the growth of the life insurance market.

The growth of insurance sector in India is considered to be the biggest in the world. The year-on-year growth of private insurers stood at 11 percent in August compared with 22 percent in July. 8 Meanwhile annuity sales also took a big hit.

The life insurance industryincluding both mortality and longevity products individual life group annuities accident and health and individual annuitieshas been growing slowly for more than a decade. The nominal compound annual growth rate CAGR from 2005 to 2015 was around 2 percent. Life insurance premiums may decline 6 globally through the end of 2020 and by 8 in advanced economies while a recovery of 3 growth is projected overall for 2021.

From 2014 to 2018 Zambia Nigeria Ghana and Uganda recorded some of the highest growth rates within the insurance industry in Sub-Saharan Africa. Key Takeaways Cash value builds up in your permanent life insurance policy when your premiums are split up into three pools. Insurance is a commodity formulated to empower you with a criterion of financial safety lest a catastrophe happens.

This number is yet expected to increase between twelve to fifteen percent 12 to 15 over the following few years. For investors the insurance industry is a slow-growing segment as compared to other financial sectors. The growth rate of life premiums ranged from -29 in Lithuania to 422 in Turkey and was even higher in Latvia.

The cash value of your policy is. May 13 2021 The Expresswire -- Global Life Insurance Software Market2021-2025 provides an all-inclusive assessment of the market and offers a precise. In the non-life sector the fastest growth rate was recorded in Luxembourg with a 1734 increase while the United Kingdom recorded the largest decline -236.

Indian people have around over 360 million strategies. Growth of the whole life insurance cash value depends on a variety of factors including the premium amount and the level of fees charged by the life insurance company the performance of the investments the insurance company makes the amount of claims paid and properly blending available policy riders. The growth of insurance sector in India is widely noticeable.

In order to grow in such environment life insurance companies will need innovation and agility in the years to come. 2 days agoLife Insurance Association of Malaysia LIAM president Loh Guat Lan said total in-force premiums increased 53 per cent year-on-year y-o-y to RM434 billion in 2020 from RM412 billion in 2019 while the total sum assured in force grew 43 per cent y-o-y to RM17 trillion in 2020 from RM16 trillion previously. Proponents of whole life insurance -- particularly those who sell it -- will tell you its a good purchase because its not just insurance.

The research study provides market overview. Cash Value vs Death Benefit. That compares with 22 percent growth in August 2018.

Teenager Life Insurance derived key statistics based on the market. Earnings that grow within a life insurance policy are one of the few items that will not increase the tax on your Social Security income. The global life insurance industry has seen significant changes over the past decade.

With whole life policies cash accounts are. Premium growth partly depends on the demand for insurance products. As a whole life insurance policy built for kids it grows with them into adulthood with coverage that doubles during age 18 at no extra cost.

If you have questions about how our Grow-Up Plan works were here for you. Assuming the positive outlook of the UAE market if we. Emerging markets once again will likely lead the way while advanced markets continue to struggle figure 2.

When it comes to helping protect your child Gerber Life Insurance has you covered with the Grow-Up Plan. Developing economiespredominantly emerging markets in Asia that were formerly small contributorshave become global growth drivers and now account for more than half of global premium growth Exhibit 1. Life insurers are faced with a tough situation and need to act quickly to remain competitive in the market.

This text provides general information.

Life Insurance It Budgets Are On The Rise Digital Insurance

Life Insurance It Budgets Are On The Rise Digital Insurance

3 Growth In Life Insurance Financial Tribune

3 Growth In Life Insurance Financial Tribune

Lively Insights Into The Us Life Insurance Industry

Lively Insights Into The Us Life Insurance Industry

Life Insurance Growth Rate Download Scientific Diagram

Life Insurance Growth Rate Download Scientific Diagram

Whole Life Insurance Complex Drivers Behind The Growth

Life Insurance Industry In Taiwan To Reach Tw 3 6 Trillion In 2024 Says Globaldata Globaldata

Life Insurance Industry In Taiwan To Reach Tw 3 6 Trillion In 2024 Says Globaldata Globaldata

Life Insurance Business In India To Contract In 2020 Due To Covid 19 Says Globaldata Globaldata

Life Insurance Business In India To Contract In 2020 Due To Covid 19 Says Globaldata Globaldata

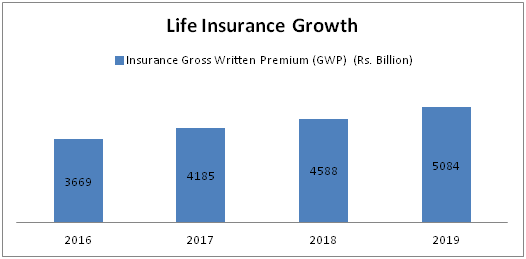

Showing Growth Of Life Insurance Sector Download Scientific Diagram

Showing Growth Of Life Insurance Sector Download Scientific Diagram

Financial Awareness Pushing Millennials To Invest In Life Insuranceaegon Life Blog Read All About Insurance Investing

Financial Awareness Pushing Millennials To Invest In Life Insuranceaegon Life Blog Read All About Insurance Investing

/global-life-and-non-life-insurance-market--growth,-trends,-and-forecast-(2020---2025)_t1.webp) Global Life And Non Life Insurance Market Growth Trends And Forecast 2020 2025

Global Life And Non Life Insurance Market Growth Trends And Forecast 2020 2025

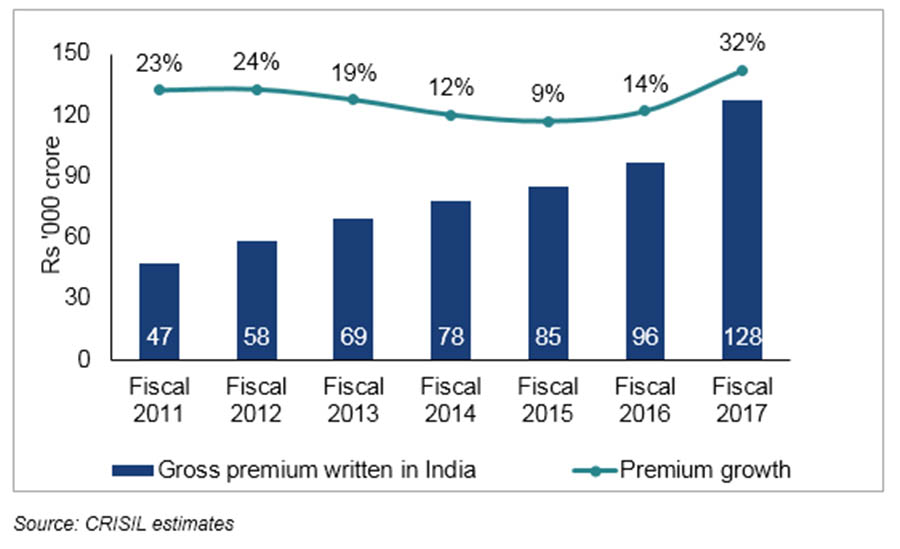

Non Life Insurance Premium Growth Hits Decadal High Forbes India Blog

Non Life Insurance Premium Growth Hits Decadal High Forbes India Blog

Comments

Post a Comment