Featured

- Get link

- X

- Other Apps

Typical Investment Management Fees

Generally the range in fee amount is due to management strategy. The average fee for a financial advisors services is 102 of assets under management AUM annually for an account of 1 million.

Independent Financial Advisor Fee Comparison All In Costs

Independent Financial Advisor Fee Comparison All In Costs

Types of Investment Management Fees Management fees whether paid as a mutual fund expense ratio or a fee paid to a financial advisor can range from 010 to over 2.

Typical investment management fees. And as the dollar amounts rise further the median investment management fee declines further to 075 over 2M 065 over 3M and 050 for over 5M with more than 10 of advisors charging just 025 or less. High costs are more visible when markets are trending down since they add to losses. If youre paying this fee you want to make sure youre getting your moneys worth.

Money site Financial Samurai puts it this way. Under this arrangement fees are charged each year as a percentage of how much money your pro manages for you. This cost may be higher or lower depending on the amount being managed.

The efficiency metric is investment management expenses divided by assets under management. An investment advisor who charges 1 means that for every 100000 invested you will pay 1000 per year in advisory fees. The typical investment adviser charges about 10 per year on the first 1 million dollars of assets under management.

If as many investors expect the next few years will be. It also highlights sectors that have experienced less movement on fee levels exploring the different dynamics. So on an investment worth 1000 you could pay more than 1250 a year on the actively managed fund or under 5 on the index fund.

Investment management fees are charged as a percentage of the total assets managed. An actively-managed portfolio usually involves a team of. The schemes reported assets under management at the end of the last financial year were about 14bn in cash so the costs translate to 84m a shade over what Michael Dobson chief executive of Schroders a publicly-quoted asset management company popular with institutional.

Sion of gross returns is relatively narrow higher asset management fees can mean that a manager that would rank in the first quartile in terms of gross performance may become just average when viewed in terms of net performance after fees. New asset classes included for the first time include. This biennial report showcases a selection of areas where investment management fees have declined significantly which in 2019 include absolute return bonds emerging market equity emerging market debt and fund of hedge funds.

You can use the ongoing charges figure to compare between funds but remember it doesnt take into account trading costs or performance fees. Not necessarily all in Your private bank or investment manager will probably charge an annual headline management fee for running your investment portfolio which is typically around 10-15 per annum as a proportion of the total assets under management. The management fee.

Here are the fees you need to know brokerage fees stock trading fees and mutual fund costs and how to limit them. In this example it would be 250 per quarter. While were fans of passive hands-off investing plenty of individual investors work with brokerage companies that actively manage their investments.

Try and check all the fees. For example if you have a balance of 500000 in your Roth IRA and your investing pro charges a 1 assets under management fee then youll pay 5000 in fees. This fee is most commonly debited from your account each quarter.

Personal Capitals white paper also includes what the popular firms charge for doing this on average. The management expense ratio MER fee is going to be different for every mutual fund and is available online on bank websites as well as third-party sites like Morningstar. Investment fees reduce your returns.

However the median fee drops to 085 for those with portfolios over 1M.

Independent Financial Advisor Fee Comparison All In Costs

Independent Financial Advisor Fee Comparison All In Costs

Investment Management Fees Fund Manager Fees

Investment Management Fees Fund Manager Fees

Average Financial Advisor Fees In 2020 2021 Everything You Need To Know Advisoryhq

Average Financial Advisor Fees In 2020 2021 Everything You Need To Know Advisoryhq

Average Financial Advisor Fees In 2020 2021 Everything You Need To Know Advisoryhq

Average Financial Advisor Fees In 2020 2021 Everything You Need To Know Advisoryhq

Independent Financial Advisor Fee Comparison All In Costs

Independent Financial Advisor Fee Comparison All In Costs

Independent Financial Advisor Fee Comparison All In Costs

Independent Financial Advisor Fee Comparison All In Costs

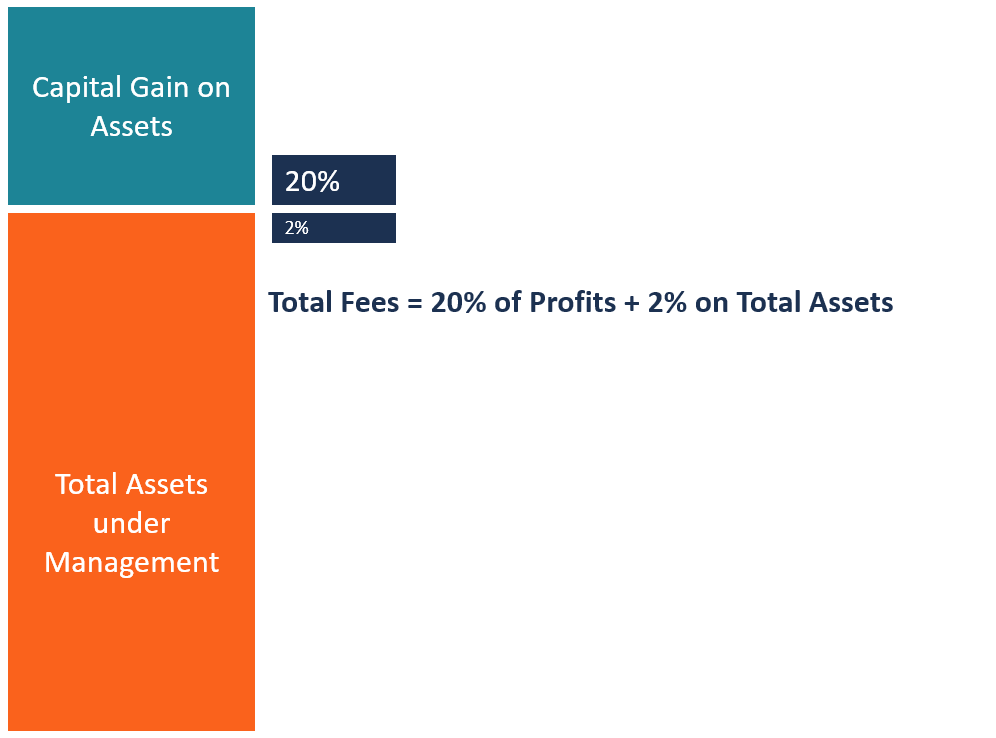

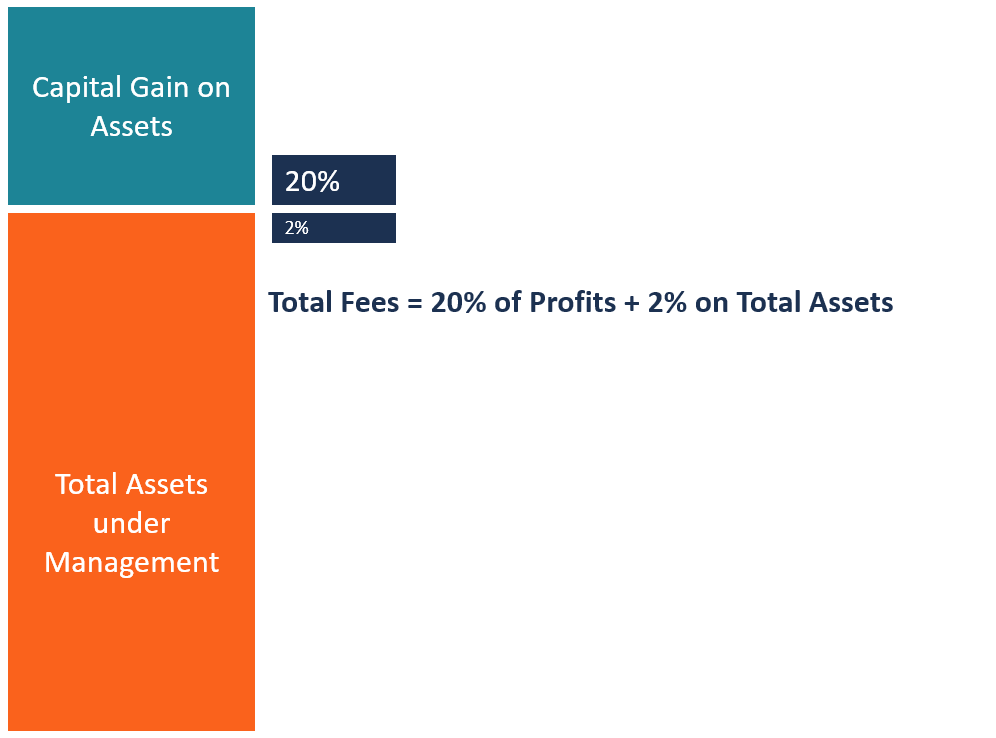

2 And 20 How The 2 And 20 Hedge Fund Fee Structure Works

2 And 20 How The 2 And 20 Hedge Fund Fee Structure Works

Investment Management Fees Fund Manager Fees

Investment Management Fees Fund Manager Fees

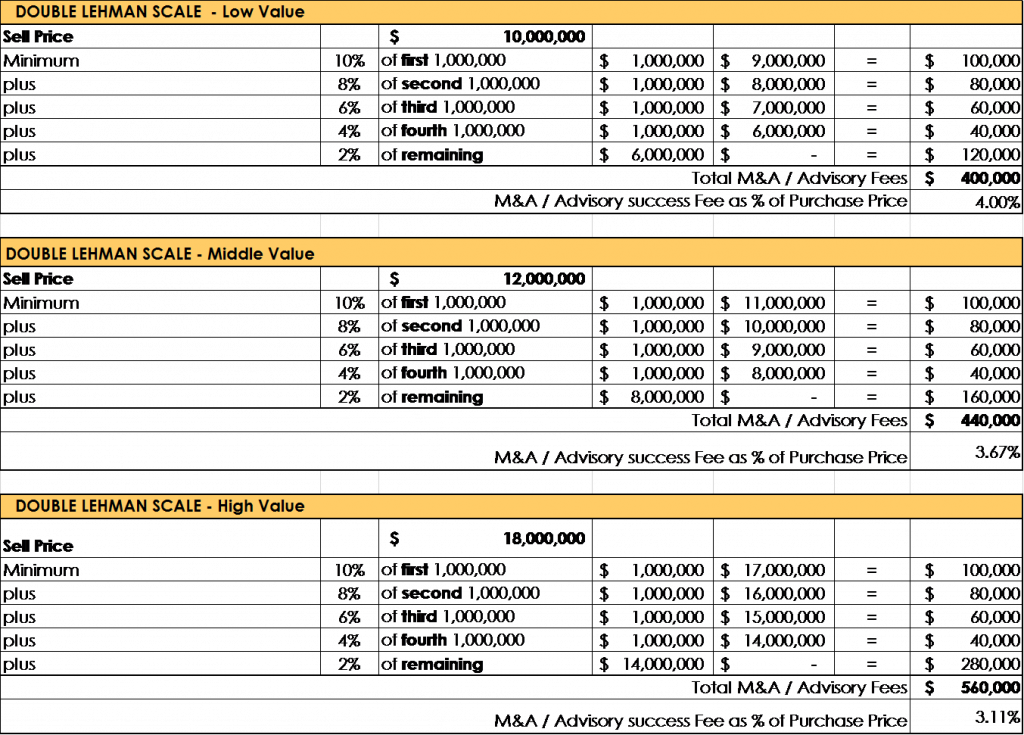

Investment Banking Fees Fees For M A Capital Advisory More

Investment Banking Fees Fees For M A Capital Advisory More

Independent Financial Advisor Fee Comparison All In Costs

Independent Financial Advisor Fee Comparison All In Costs

Independent Financial Advisor Fee Comparison All In Costs

Independent Financial Advisor Fee Comparison All In Costs

Average Financial Advisor Fees In 2020 2021 Everything You Need To Know Advisoryhq

Average Financial Advisor Fees In 2020 2021 Everything You Need To Know Advisoryhq

Financial Advisor Blog Investment Management Fees Under The New Tax Law Gordian Advisors

Financial Advisor Blog Investment Management Fees Under The New Tax Law Gordian Advisors

/dotdash_Final_Two_and_Twenty_Oct_2020-01-7ca86fbd38b64e59a879a71b9ad779eb.jpg)

Comments

Post a Comment