Featured

Msci Factor Etfs

Return on equity earnings variability and debt-to-equity. MSCI has been at the forefront of driving factor innovation for over 40 years beginning with Barra.

Blackrock Launches Ishares Msci Emu Multifactor Etf Etf Strategy Etf Strategy

Blackrock Launches Ishares Msci Emu Multifactor Etf Etf Strategy Etf Strategy

55I LLC boosted its stake in iShares Edge MSCI USA Value Factor ETF by 157 during the 1st quarter.

Msci factor etfs. Designed to represent the performance of equity in multiple factors while benefiting from diversification and flexibility. The absolute values of short positions are included but treated as uncovered the funds holdings date must be less than one. Approximately USD 236 billion in assets are estimated to be benchmarked to MSCI Factor Indexes1.

Based on MSCIs Global Equity Factor Model MSCI FaCS includes 8 Factor Groups and 16 Factors. Large- and mid-capitalization stocks as identified through three fundamental variables. To be included in MSCI ESG Fund Ratings 65 of the funds gross weight must come from securities covered by MSCI ESG Research certain cash positions and other asset types deemed not relevant for ESG analysis by MSCI are removed prior to calculating a funds gross weight.

MSCI Emerging Markets Diversified Multiple-Factor Index ETF Tracker The index is based on the broader MSCI Emerging Market Index which tracks the performance of emerging market large and mid cap equities from 23 countries. Large- and mid-capitalization stocks with value characteristics and relatively lower valuations before fees and expenses. Quote Fund Analysis Performance Risk Price Portfolio Parent All ETFs.

The MSCI Factor Mix A-Series MSCI Factor Mix A-Series Capped and MSCI Quality Mix E-Series are part of MSCI Factor Mix Indexes. The increasing popularity of Factor Investing can create the need for standards. 24 rows Quality Factor ETFs Quality Factor ETFs are made up of securities.

To be included in MSCI ESG Fund Ratings 65 of the funds gross weight must come from securities covered by MSCI ESG Research certain cash positions and other asset types deemed not relevant for ESG analysis by MSCI are removed prior to calculating a funds gross weight. Factor Investing is transforming the way investors construct and manage portfolios. The iShares MSCI USA Quality Factor ETF seeks to track the investment results of an index that measures the performance of US.

It effectively captures names with strong positive momentum in a. IShares MSCI Intl Quality Factor ETF IQLT Morningstar Analyst Rating Analyst rating as of Oct 23 2020. 55I LLC now owns 520148 shares of the companys stock valued at.

Large and mid-capitalization stocks that have favourable exposure to target style. The iShares MSCI USA Value Factor ETF seeks to track the performance of an index that measures the performance of US. The MSCI factor indexes are rules-based indexes that capture the returns of systematic factors that have historically earned a persistent premium over long periods of timesuch as Value Low Size Low Volatility High Yield Quality and Momentum and Growth.

MSCI Factor Mix Indexes. The iShares MSCI USA Size Factor ETF seeks to track the investment results of an index composed of US. Large- and mid-capitalization stocks with relatively smaller average.

L ooking today at week-over-week shares outstanding changes among the universe of ETFs covered at ETF Channel one standout is the iShares MSCI USA Quality Factor ETF Symbol. MSCI Factor Classification Standards. IShares MSCI USA Value Factor ETF VLUE Each iShares ETF has a particular tilt one biased toward small firms another toward firms whose stock value is.

QUAL where we have. The absolute values of short positions are included but treated as uncovered the funds holdings date must be less than one. MSCI Factor ESG Target Indexes are designed to represent the performance of a strategy that seeks systematic integration of ESG Environmental Social and Governance into Factor Investing.

IShares Edge MSCI International Momentum ETF is a great foreign stock momentum strategy. The index focuses its exposure on four factors including value momentum quality and low size. The MSCI USA Diversified Multiple-Factor Index is composed of US.

They help provide a set of Factor Indexes that aim to be more ESG-aware.

Dissecting 3 Big Quality Etfs Etf Com

Dissecting 3 Big Quality Etfs Etf Com

Http Info Msci Com How Can Factors Be Combined

Ishares Msci Usa Quality Factor Etf Experiences Big Outflow Nasdaq

Ishares Msci Usa Quality Factor Etf Experiences Big Outflow Nasdaq

Msci Has Defined Smart Beta Better Etf Com

Msci Has Defined Smart Beta Better Etf Com

Ishares Msci Usa Min Vol Factor Etf Experiences Big Outflow Nasdaq

Ishares Msci Usa Min Vol Factor Etf Experiences Big Outflow Nasdaq

Ishares Edge Msci Usa Momentum Factor Etf Experiences Big Outflow Nasdaq

Ishares Edge Msci Usa Momentum Factor Etf Experiences Big Outflow Nasdaq

Https Www Morningstar Com Content Dam Marketing Shared Research Methodology 869053 Frameworkanalyzingmultifactorfunds Pdf

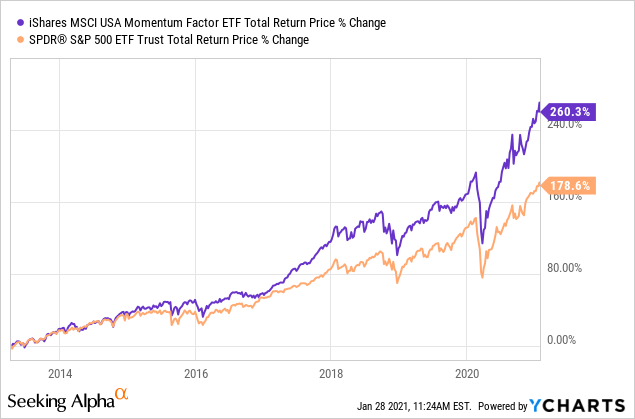

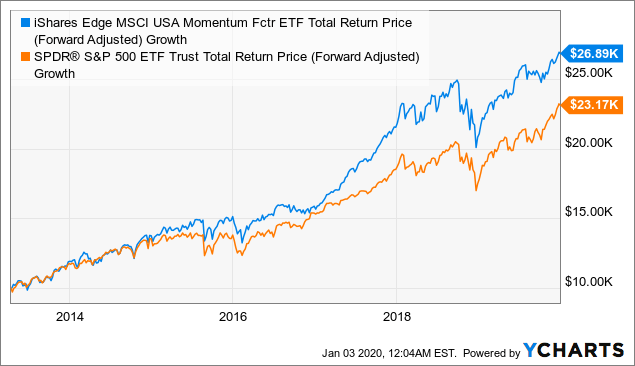

Mtum Ishares Msci Usa Momentum Factor Best Of Class With 5 Years Of History Bats Mtum Seeking Alpha

Mtum Ishares Msci Usa Momentum Factor Best Of Class With 5 Years Of History Bats Mtum Seeking Alpha

Https Www Msci Com Documents 10199 71ad36ee Cefe 4bca 92d8 B52202167031

Growth Momentum Etfs Gain Ground Etf Com

Growth Momentum Etfs Gain Ground Etf Com

Http Info Msci Com How Can Factors Be Combined

Mtum Momentum Outperformed Over 80 Of Msci Benchmarks Last Decade Bats Mtum Seeking Alpha

Mtum Momentum Outperformed Over 80 Of Msci Benchmarks Last Decade Bats Mtum Seeking Alpha

Ishares Msci Usa Momentum Factor Etf Experiences Big Inflow Nasdaq

Ishares Msci Usa Momentum Factor Etf Experiences Big Inflow Nasdaq

Comments

Post a Comment