Featured

Tax Lien Investing Illinois

Many active investors are turning to tax liens to earn a little extra income. The auction is open to the public.

Buying Illinois Tax Liens And How To Make A Profit Ted Thomas

Buying Illinois Tax Liens And How To Make A Profit Ted Thomas

Most counties require the bidder to pre-register at least 10 days ahead of the auction schedule.

Tax lien investing illinois. If they pay in the 6th month most do pay by then you have earned 15 x 6 9. Illinois interest rate is 24 on farm land and 36 for a full year. Anzeige Free For Simple Tax Returns Only With TurboTax Free Edition.

You are not buying the property. You are buying the right to collect the past due property taxes plus interest. Very populated counties have competitive sales.

Illinois interest rate is 24 on farm land and 36 for a full year. So it takes just over 2 months of interest just to break even. The State Tax Lien Registry is an online statewide system for maintaining notices of tax liens filed or released that are enforced by the Illinois Department of Revenue IDOR.

You can earn as much as 18 percent interest every six months 36 annually. 9 - 3467 5533. Illinois is probably one of the best tax lien certificate investing states because the interest rate is high and the redemption period is short.

You must contact the Lien Unit by phone at 217 785-5299 by email at REVLienillinoisgov or by mail at. Anzeige Free For Simple Tax Returns Only With TurboTax Free Edition. The lien is sold at a tax defaulted property auction.

Because tax lien investing involves so much due diligence it might be worthwhile to consider investing passively through an institutional investor who is a member of the National Tax Lien. The liens included in the State Tax Lien Registry are liens filed by IDOR or the Department of Employment Security on the real property and personal property tangible and intangible of taxpayers other people or entities in. County tax sales in Illinois are held in November and the redemption period is 2 years.

When you buy a tax lien in Illinois you arent buying the property. Get Your Max Refund Today. Questions and Answers How do I get a State of Illinois tax lien released or payoff amount.

Tax lien investing is the act of buying the delinquent tax lien on a property and earning profits as the property owner pays interest on the certificate or from the liquidation of the collateral securing the loan. Investing Passively Through an Institutional Investor Tax lien investing requires a significant amount of research and due diligence so it may be worth it to consider investing passively. On January 1 2018 the new State Tax Lien Registration Act went into effect changing how state tax liens are filed in Illinois.

The investor willing to accept the lowest amount of interest is rewarded the lien. A 2-year redemption period is typically the standard in Illinois. Youre simply buying the right to collect the taxes that are owed.

Get Your Max Refund Today. Most counties require the bidder to pre-register at least 10 days ahead of the auction schedule. In Illinois a tax lien auction is your chance to invest to make big profits.

Visit this resource to learn more. With TurboTax Its Fast And Easy To Get Your Taxes Done Right. If the owner pays in the first 2 months you are losing money.

However if the taxes arent paid within 2 or 3 years you may be able to go to court and foreclose on the property. County tax sales in Illinois are held in November and the redemption period is 2 years. It is the only location available to search for liens.

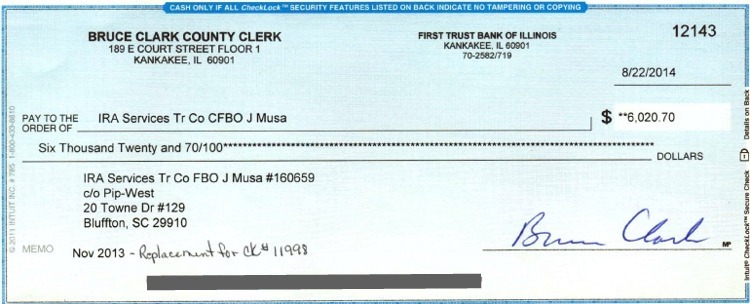

With TurboTax Its Fast And Easy To Get Your Taxes Done Right. The act created a single centralized Illinois State Tax Lien Registry for filing notices of tax liens. Tax Lien Investing 101 The PIP Group focuses on the highest interest yield tax liens the highest amount of equity to secure the lien and a high-yield compounding effect through reinvestment of redemption proceeds in more tax liens.

The owner of the tax lien certificate has the option to extend the redemption period to 3 years from the date of the sale. If you won the lien at 18 you earn 15 per month on the lien amount 3000.

How To Buy Tax Liens In Illinois With Pictures Wikihow

How To Buy Tax Liens In Illinois With Pictures Wikihow

Investing In Tax Liens The Rate Of Return Ash Mcginty

Investing In Tax Liens The Rate Of Return Ash Mcginty

Amazon Com How To Buy State Tax Lien Properties In Illinois Real Estate Get Tax Lien Certificates Tax Lien And Deed Homes For Sale In Illinois Ebook Mahoney Christian Kindle Store

Amazon Com How To Buy State Tax Lien Properties In Illinois Real Estate Get Tax Lien Certificates Tax Lien And Deed Homes For Sale In Illinois Ebook Mahoney Christian Kindle Store

How To Buy Tax Liens In Illinois With Pictures Wikihow

How To Buy Tax Liens In Illinois With Pictures Wikihow

Illinois Tax Lien Deeds Real Estate Investing Financing Book How To Start Finance Your Real Estate Investing Small Business Mahoney Brian 9781537488585 Amazon Com Books

Illinois Tax Lien Deeds Real Estate Investing Financing Book How To Start Finance Your Real Estate Investing Small Business Mahoney Brian 9781537488585 Amazon Com Books

Tax Lien Investing 101 How To Invest In Tax Deeds And Tax Lien Cert

Tax Lien Investing 101 How To Invest In Tax Deeds And Tax Lien Cert

Secondary Tax Lien Redemption Tax Lien Investing Tips

Secondary Tax Lien Redemption Tax Lien Investing Tips

What Are Tax Liens And How Do They Work The Pip Group

What Are Tax Liens And How Do They Work The Pip Group

Illinois Tax Lien Sales Who Bids On Tax Liens At 0 R A M S

Illinois Tax Sales Tax Liens Youtube

Illinois Tax Sales Tax Liens Youtube

How To Buy Tax Liens In Illinois With Pictures Wikihow

How To Buy Tax Liens In Illinois With Pictures Wikihow

Illinois Tax Sales Explained Tax Liens Tax Deeds A Goldmine For Real Estate Investors Youtube

Illinois Tax Sales Explained Tax Liens Tax Deeds A Goldmine For Real Estate Investors Youtube

Leaning Into Tax Lien Investing Dsnews

Leaning Into Tax Lien Investing Dsnews

Illinois Tax Lien Deeds Real Estate Investing Financing Book How To Start Finance Your Real Estate Investing Small Business Mahoney Brian 9781537488585 Amazon Com Books

Illinois Tax Lien Deeds Real Estate Investing Financing Book How To Start Finance Your Real Estate Investing Small Business Mahoney Brian 9781537488585 Amazon Com Books

Comments

Post a Comment