Featured

How To Pass Money To Heirs Tax Free

Use RMDs from the IRA to pay premiums. Upon the death of the second spouse your heir gets 1-5 million dollars tax free.

Rich Americans Seize Chance To Pass On Wealth Tax Free Investmentnews

Rich Americans Seize Chance To Pass On Wealth Tax Free Investmentnews

Families intend to pass on all their wealth to their heirs but are not.

How to pass money to heirs tax free. Ask a Tax Expert. Turbo Tax and many other tax preparation software programs also makes record keeping easier by consolidating your financial information. Previously all heirs had their entire life expectancy to take withdrawals from inherited IRAs so they were able to stretch out these accounts and the tax.

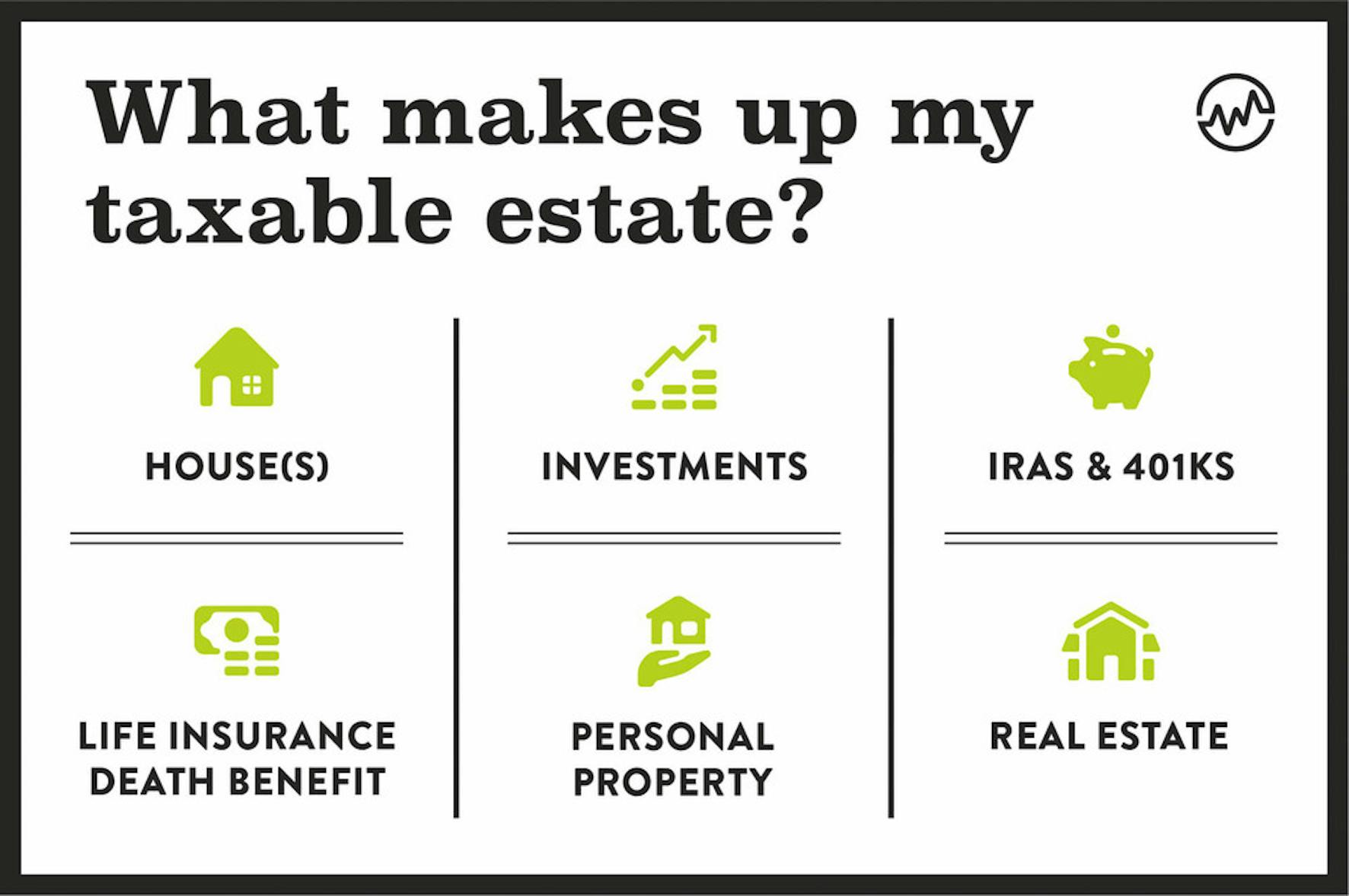

There is no federal tax deduction. This advanced legal planning strategy involves dividing a couples living estate between two retractable trusts. Done correctly this effectively doubles the amount a couple can pass on to their heirs without the hitch of the federal estate tax.

If you dont remember a Roth IRA uses post-tax dollars and it grows tax free. An RESP would ensure the money is used for the grandchildrens education and it can be transferred to the RESP with no tax implication to your spouse. That way there will never be any gift or estate tax on the appreciation.

Apparently these second-to-die policies may have internal rates of return above 5 per year. Once your money is in a 529 the earnings will be deferred on federal and most state tax returns. It is often assumed that wealthy Canadians have it all figured out when passing money from one.

While tax-free annual exclusion gifts and medical and educational payments are typically made to children and grandchildren the same tax rules apply to gifts and payment for the benefit of other people including children-in-law and grandchildren-in-law parents friends and other family members. What makes this plan especially unique is that your spouse and direct heirs can receive the Roth IRA and not have any RMDs. So if you want to leave money to your family and donate to charity talk to.

The Best Way to Give Money to Your Heirs Using the Stretch IRA. When you do your estate planning you can make a plan to pass your house tax-free to any heirs that you would like. Here are examples of the three tax maneuvers.

0 Federal 0 State 0 To File offer is available for simple tax returns with TurboTax Free Edition. One of the best ways to move assets into an IDGT is to combine a modest gift into the trust with an installment sale of the property. Since it is a second to-die-policy it is less expensive than a single life policy.

The donation limits are high and typically range between 300000 and 400000 per beneficiary. And there is no tax due when taking the money out for qualified education expenses. The usual way to.

If your taxes are a bit more involved fees start at 2995. Tips to Pass a House Tax-Free Through a Will. A stretch IRA is referring to a Roth IRA.

Leave your question here. Each trust can pass up to the 1118 million dollars to heirs tax-free. Families aiming to pass their wealth down the generations should not be put off by the taxmans fresh squeeze on schemes that aim to reduce inheritance tax.

As non-profits they wont pay taxes on any legacy you leave them. Thats right death benefits are tax free. A simple tax return is Form 1040 only without any additional schedules OR Form 1040 Unemployment Income.

If you have a simple return you can file for free. It all goes to your heirs tax-free. So if youre buying and holding appreciating property or wish to protect a family business from estate tax I suggest you consider a Grantor Retained Annuity Trust.

Americas richest families have found ways to avoid estate taxes through legal loopholes that allow them to pass money to their heirs tax-free. At the end of those 10 years the stock is free and clear of estate taxes and will be transferred to the heirs on the passing of the settlor.

Use These Tips To Pass Your House To Your Heirs Tax Free Savingadvice Com Blog

Use These Tips To Pass Your House To Your Heirs Tax Free Savingadvice Com Blog

4 Rules For Giving Your Heirs Money While You Re Alive Kendal Corporation

4 Rules For Giving Your Heirs Money While You Re Alive Kendal Corporation

The Best Way To Pass On Your Inheritance

The Best Way To Pass On Your Inheritance

Protecting Yourself And Heirs From Inheritance Theft

Protecting Yourself And Heirs From Inheritance Theft

How To Leave Money To Your Heirs Optimize Inheritance

How To Leave Money To Your Heirs Optimize Inheritance

Pass On Wealth To Heirs Using These Strategies Wheeler Accountants

Pass On Wealth To Heirs Using These Strategies Wheeler Accountants

The Tax Smart Way To Leave Money To Heirs Charity Kiplinger

The Tax Smart Way To Leave Money To Heirs Charity Kiplinger

Passing On Tax Free Wealth Pacific Portfolio

Passing On Tax Free Wealth Pacific Portfolio

The Best Ways To Leave Your Wealth To Your Heirs Yield Hunting

The Best Ways To Leave Your Wealth To Your Heirs Yield Hunting

Pass On Wealth To Heirs Using These Strategies Lvbw

Pass On Wealth To Heirs Using These Strategies Lvbw

Inheritance Tax How Much Will Your Children Get Your Estate Tax Wealthfit

Inheritance Tax How Much Will Your Children Get Your Estate Tax Wealthfit

Inheritance Tax How Much Will Your Children Get Your Estate Tax Wealthfit

Inheritance Tax How Much Will Your Children Get Your Estate Tax Wealthfit

Tips For Giving Away Money To Family Members

Tips For Giving Away Money To Family Members

Comments

Post a Comment